Content

How to Build a Loan App: General Overview

How to create a money lending app? How do loan applications work? What features should be added to such an application? How much does it cost to start a loan app? In our new article, you will find answers to these and all related to the topic questions.

Based on the experience, the RewiSoft team will share best practices and tips on how to build a loan app and succeed. We will provide you with all of the required data and information about the design and development process, as well as how to create a money lending app without mistakes.

Contact us for a Free Consultation

What Is a Money Lending App?

Money lending app is an application using which people can get loans instantly. To get a loan, people just need to register, verify their data and fill out a profile.

There comes a time in everyone’s life when they don’t have enough money. While cash lending is not a new concept in the market, the growing impact of digitization has successfully revolutionized the lending process. Gone are the days when people preferred to take out loans from banks or credit unions. Because not only do they involve complex procedures, but people with dynamic lives have no time to visit banks to complete the formalities.

The severe impact of the pandemic wave has pushed people into financial crises worldwide. Social distancing has increased. People preferred lending platforms that make it possible to get a loan quickly and easily without interacting with banks, loan brokers, or financial institutions.

What Is a Peer-to-Peer Lending App?

A peer-to-peer lending app is a lending platform that links lenders and borrowers. Lenders and borrowers are ordinary people. Borrowers can request a loan, and lenders, in turn, can give it and receive a percentage of it as a result. Both lenders and borrowers are equal players in this type of loan application. Banks, financial institutions, loan brokers, and other intermediaries are not engaged in the loan process.

According to Statista, we expected the global P2P lending market to reach $1 trillion. Therefore, today more and more companies are beginning to be interested in how to create a money lending app.

How Do Loan Apps Work?

Before we tell you how to create a money lending app, let’s investigate how such apps function. Money lending applications have a fairly basic simple operation. Here are a few steps that every person who wants to build a money borrowing app and use it should go through:

- Application installation.

- Registering a new account or logging in with a username and password.

- Entering the amount of money to borrow or the amount to lend.

- Choosing an interest rate that is the most suitable.

- Connecting bank cards to the application.

These few steps are the same for almost all money lending applications. As previously said , one of the benefits of using money lending applications is that no intermediaries are engaged in the loan process. Borrowers and lenders are on an equal footing here. Both sides may directly negotiate loan rates and payback arrangements with one another.

Following a security check, the borrower submits a loan application that is accepted by the platform. After that, the lender already has a list for lending, he can approve or reject applications. The platform receives a percentage of the transaction, as well as monthly membership fees or in any other way. Still, the lack of intermediaries assures that the interest rates and conditions are appropriate for all clients.

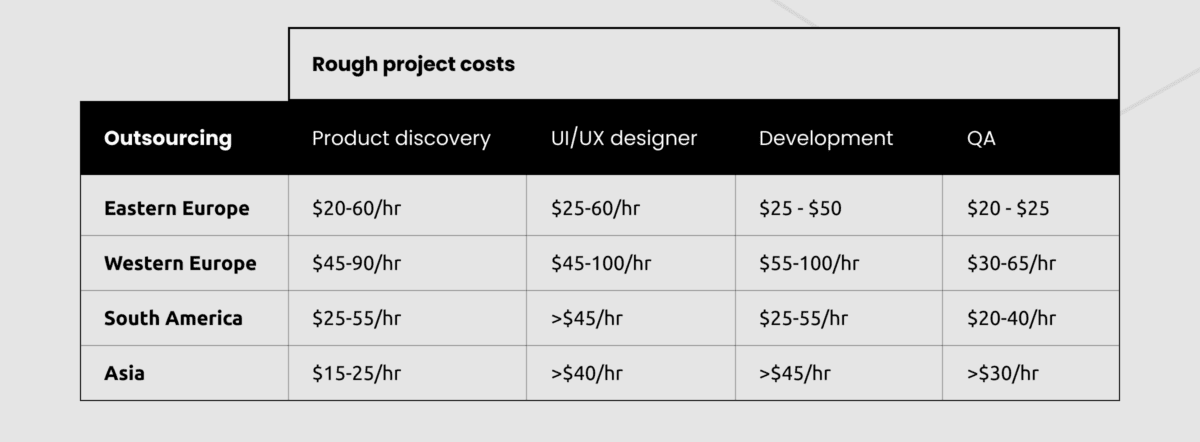

How Much Does it Cost to Develop a Loan App?

The starting price for custom loan app development at RewiSoft is $40,000.

The cost of building a money lending application depends on the scope of work, development approach, technology stack, and team size.

Tell us about your project and get a free estimate

RewiSoft Experience in Loan Lending App Development

RewiSoft team has a wealth of experience and know how to build a loan app which will be popular with a large number of users. We provide our clients from the FinTech industry with outstanding software development services and help to start loan apps.

One of our customers, HelpPays, is the largest marketplace for short-term peer-to-peer loans. It allows you to lend/borrow up to $2,000 for up to 9 months. Our customer needed a scalable, high functioning and visually appealing lending app. To implement our customer’s idea, we first started reviewing and analyzing product sketches. Based on this review, we have identified several areas for further work:

- Product architecture development. In order for the product to be scalable and work smoothly, we have created a robust product architecture. Thanks to the organized information architecture, HelpPays users achieve their goals on the platform in a few clicks.

- Ensuring full security. Since this platform is associated with money transactions, one of the requirements of our customer was to ensure the complete security of the application. To do this, our team used advanced methods and technologies.

Working together with the customer, the RewiSoft team was able to turn the client’s idea into reality and build a loan app.

Soon the platform will be available for work, and we will be able to get the first results from users.

Another customer, Gojo, a tablet application for quick and efficient microloans, had an existing platform. Our work was divided into two iterations:

- The first was the creation of a repayment flow, i.e., the flow of how an officer will receive money from people who take a microloan.

- The second iteration of building a money borrowing app was the development of an agent persona. An agent has more limited functionality than an officer but can also handle loans and process management. Our task was to develop the functionality and flows that the agent could use.

The main challenges of this project were:

- Build a high secure platform. Using all the necessary security measures and standards, we provided the platform with full security and secured user accounts from money theft.

- Adapt the platform to the region specifics. Since the Gojo platform was used in a certain region, we needed to adapt all the functionality and design to the region’s specifics.

As a result, our team developed all the necessary application functionality and optimized the work of the existing one.

With the help of the updated application, Gojo clients get microloans several times faster, more conveniently, and, most importantly, reliably.

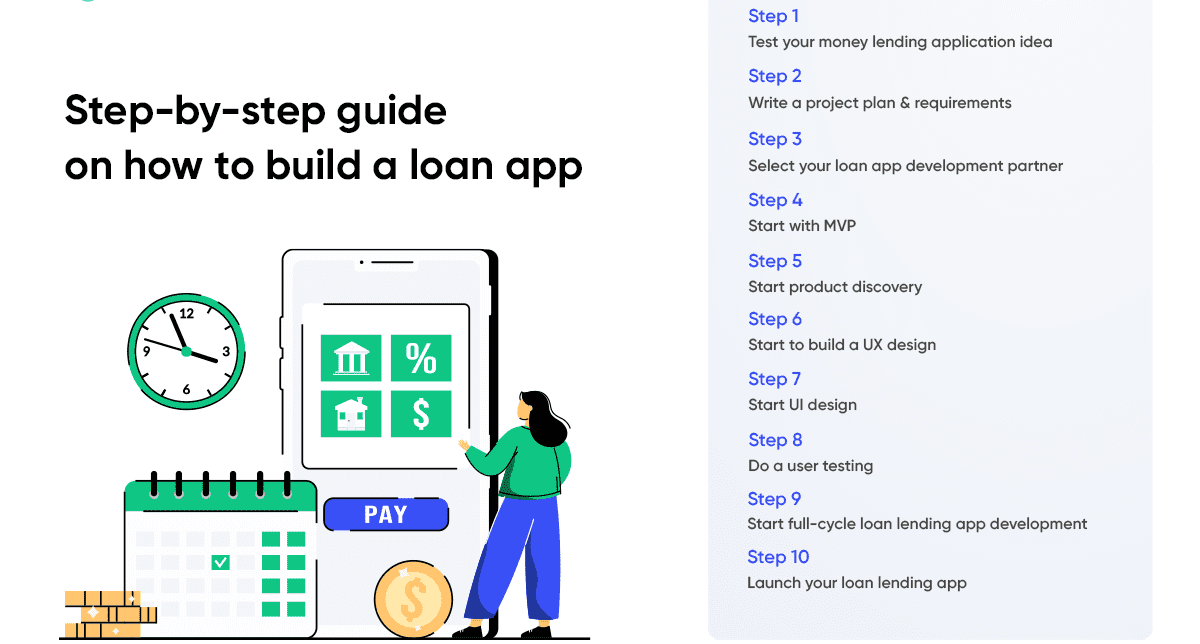

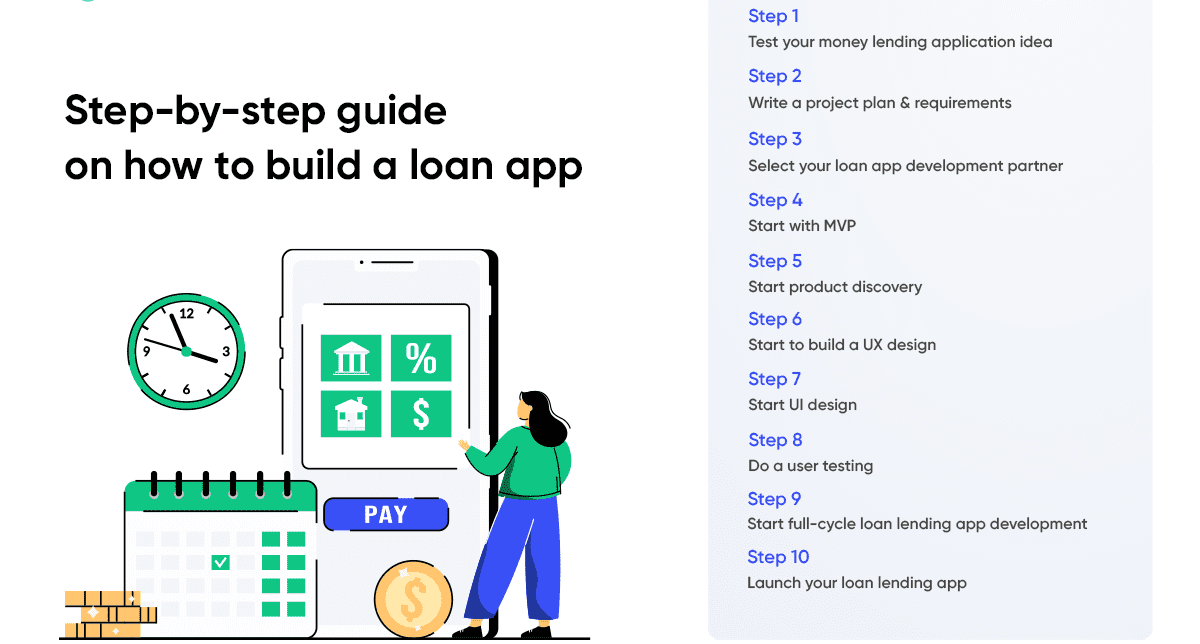

Step-by-Step Guide on How to Build a Loan App

Now let’s get down to the most interesting and important part – the process of creating a money lending application. We have prepared a small guide that will help you understand how to build a loan app step by step.

Step-by-Step Guide on How to Build a Loan App

Step 1. Test your money lending application idea

First, you need to test your idea before building a money borrowing app. Study the market and similar products to yours. Make a survey of target users. Find out what they lack in the application, what functionality will be convenient for them, what they would like to add to it, etc.

The more information you get at this stage, the easier it will be for you to start a loan app. Do not forget that you are making a product for users. Therefore, you should take into account their opinion.

Step 2. Write a project plan & requirements

Next, write a detailed development plan for your product. Every step you take should be itemized. A clear plan is always the key to success in building a money borrowing app, as thoughtfulness and organization help keep all processes under control.

Also, write a list of requirements for your future product. This document will help you and your team always be aware of what needs to be done in order for the product to turn out the way you originally intended it. Usually, the design & development requirements (specifications) document includes the following things:

- Full project overview

- Main needs and goals

- Target audience

- Functional requirements and desired set of features

- Aesthetic aspects

- Non-functional details

- Recommendation and prohibitions

- Questions

To learn how to write specifications read our article How To Write Specifications? [Quick Guide].

Step 3. Select your loan app development partner

The next step is to select a reliable contractor and partner. There are several ways to find a good team to develop a great product and start a loan app:

- Use social networks. On LinkedIn, for example, you can find profiles of design and development agencies and their representatives. Evaluate their experience, main areas of work, previous clients and projects, etc.

- Use rating sites. For example, on the Clutch website, you can find many design and development teams, the projects they’ve worked on, clients’ testimonials, and more.

- Colleagues and partners. Ask your colleagues, partners or friends about their experience of working with good teams. Perhaps they can advise you on a great design and development team.

- Contact RewiSoft. We are always open to new and interesting projects. So don’t hesitate to get in touch with us. We will be happy to discuss the details of your project.

Step 4. Start with MVP

After you select a team for your project, start preparing the MVP. Product MPV is essential for anyone who wants to approach the development of a new application carefully and rationally. It avoids many mistakes and gives advantages over those who immediately create the whole product in most cases.

- First of all, you will be able to check the viability of your application without spending a lot of time, effort and money on it. If it turns out that the audience is not interested in your offer, then you will not have to regret over-investing, and you can move in another direction.

- You will be able to define and understand the audience better. You will know if people need your product, and if they do, then for what and how they will use it.

- You will understand what you have worked on and where changes are needed. Perhaps your brainchild or its individual parts will have to be changed entirely due to negative feedback. However, this is for the best: this way you can develop what will cause high demand.

- If the MVP launch is successful, you will get the first profit and customers long before the final version is created. Thanks to this, you will quickly return on investment and find people who are more likely to become your regular users.

In addition, people may not need some of the features that you planned to spend a lot of time and effort on. That will reduce cost and time and allow you to focus on what your audience needs the most.

Step 5. Start product discovery

Product discovery includes drawing up the business logic of your product and competing research that will help you create a solution that will outperform other players in the market. You also need to determine what problem your product will solve, whether people will buy and use your product, and whether your solution will work.

The more information you collect and prepare at this stage, the easier it will be for your design and development team to understand what kind of product they need to create. It will also increase the likelihood that you will be able to create a truly valuable solution.

You should also do business analysis before building a money borrowing app. Business analysis is a detailed assessment of the prospects for the commercialization of a new product concerning the initial investment.

In simple terms, a business analysis allows you to assess how profitable the development of a new product is, how quickly it will pay off, and how much income it can generate.

At this stage, as a product founder, you get a clear idea of what needs to be developed, in which direction to move, what to consider when developing a product, and how to handle all development processes.

Step 6. Start to build a UX design

Next, start creating UX design. How to build a loan app that will be user-friendly? UX is vital for any mobile application. Here are 6 steps to successful UX design:

Study the users. The first step is to understand exactly who you are designing for. There are many methods to get information about your users. Combine quantitative and qualitative analytics and feedback data. Only by understanding your users’ goals, needs, and desires can you create an effective design for them.

Define scenarios. Next, based on your research, be clear about what you (or rather your users) are trying to achieve. Create the perfect journey map for your client and identify any possible barriers on the way. Define as many scenarios and uses as possible for your product/service.

Formulate an idea. Gather together all the collected information and start brainstorming. Create a storyboard or mood board to visually convey the problem you are trying to solve.

Create a prototype. Prototyping is the most effective way to bring your idea to life even before the development stage. Lay out a mock-up of the interface with all its important components on paper, and then ask as many people as possible to replay the script. This process will help you identify any potential barriers or unexpected user behavior that you may have overlooked.

Test it. Testing is vital for UX design. It doesn’t have to be a long, laborious process. According to the Nielsen Norman Group, 85% of all problems on your site can be detected by just 5 users.

Repeat steps as needed. Depending on your testing results, you may need to go back to the idea stage and find some other alternative solutions. The UX design process is iterative: some steps need to be repeated to achieve the desired result.

Step 7. Start UI design

How to build a loan app that will be visually attractive for users? The UI is focused on making the user experience a pleasant experience. UI design is all the elements that the user sees and interacts with.

For example:

- buttons

- text fields

- checkboxes

- sliders

- search bars

- tags

- icons

Step 8. Do a user testing

How to build a loan app without any bugs and mistakes? Once your UX/UI is ready, you need to test everything thoroughly. Testing will help you identify errors and problems at an early stage and fix them in time. Also, testing will help you understand how well your design is understandable and convenient for users.

Step 9. Start full-cycle loan lending app development

Now comes the most crucial stage. You need to turn the design into a real working product and become closer to building a loan app.

After the design team has created a product design, the development team begins work on writing the code for all product components. The development stage is divided into front-end and back-end development.

The front end is responsible for the client part of the system, and the back end is for the server. Thanks to an integrated approach, the product is developed taking into account all technical standards and requirements.

Depending on the project’s scope of work, we assign 2+ developers to implement the server side of the application, APIs, and business logic and transform UI design into a functioning user side.

At RewiSoft, we adhere to the Agile methodology to make the process flexible to changing customer requirements and, at the same time, meet strict deadlines. We perform continuous testing once the feature is ready to deploy to reduce the development costs and time to release.

Step 10. Launch your loan lending app

Now is the time for the market to see your product! The product launch process causes meticulous preparation and should be carried out systematically to guarantee that clients accept the product favorably. The following are the major steps to start a loan app:

- Target audience identifying

- Unique product packaging creation

- Slogan and timeline creation

- Competitors analysis

- Customer onboarding creation

- Website creation

- Advertising

How to Build a Loan App Without Mistakes?

Since our team is quite experienced in developing money lending applications, we have prepared some tips for you on how to start a loan app without mistakes. Let’s take a closer look at each of them:

You need a strong finance & lawyer team

Your team should have people who are well versed in finance and know the laws of your region. Thus, you will be able to build a money borrowing app that will fully comply with the requirements of the financial market and local laws.

Make good loan agreements

You also need to prepare loan agreements well. Here you will need the help of lawyers. Agreements should be drafted correctly and in accordance with the law. Properly drawn-up contracts will let users know that the application is reliable and stable.

Remember about law restriction in global in case you want to scale

If you are planning to scale your money lending application in the future, you need to think about a loan restriction in your location. Study the restrictions in the financial sector in your country before you start a loan app so that you do not have to change a lot in the future.

Start with MVP

We recommend starting a loan app with MVP. MVP will help you test your product idea and understand what needs to be added to the application and what should be removed.

The Legal Side of Loan Lending Mobile App Development

Here are some legal points to remember when building a money borrowing app:

- GDPR compliance. If you develop an application for the EU market, you should ensure that your loan app is GDPR compliant. GDPR, or General Data Protection Regulation, went into force on May 25, 2018. If you don’t want to get fined, you can’t disregard or skip this step.

- CCPA compliance. The California Consumer Privacy Act (CCPA) is the law you must follow if you develop software for California citizens. This law’s major purpose is to give people more control over their personal data. If California is your target market, you must make your money lending app CCPA-compliant beginning January 1, 2020.

- Remember that local rules and regulations may differ; everything depends on the place you intend to create a money lending application. So, whether Asia, the United Kingdom, Australia, or other locations are your target markets, pay attention to each region’s local rules.

The Main Tech Requirements for Loan Lending Mobile App Development in 2024

In order to build a loan app that will function smoothly, it is necessary to strictly adhere to the technical requirements and standards for loan app development. Let’s look at the main tech requirements for loan lending app development in 2024.

The Main Tech Requirements for Loan Lending Mobile App Development

Robust information architecture

A well-built information architecture affects the logic of the product, its navigation and the user experience. If you miss this moment, most likely, your product will not function as you expect it to. We recommend that you pay maximum attention to building an information architecture, as this is the main foundation for creating a high-performing loan lending application.

Right tech stack

A properly selected tech stack for loan app development will ensure that you create an application that will work without mistakes and meet all user expectations accordingly. Companies often choose tech stacks for their project without consulting experts. An incorrectly chosen tech stack can affect the development time and the quality of the product as a whole.

Well-thought-out product logic and navigation

Logic and navigation are one of the most important components of the loan lending app. They directly affect the product’s functioning, user experience and the speed of its work. The better thought out the logic and navigation of the product, the higher the likelihood that users will stay with your product for a long time. We recommend that you do not complicate the navigation of your product but make it more understandable to the regular user.

Implementation of trending technologies

During loan app development, it is important to keep in mind the implementation of trending technologies. Today, there are a large number of tools and technologies that can be used in Fintech products. For example, it can be an AI module that will check the quality of a person who wants to borrow money or automatic processing of an application. Also, you can, for example, use blockchain to encrypt data or Big Data to collect and better process user data.

Must-Have Features for Loan App Development in 2024

How to create a money lending app that will be in demand and competitive? Building a money borrowing app, don’t forget to add the following features:

Registration

As with other apps, make sure your app has this feature and allows users to sign in to the app with their email address, phone number, and password.

Personal account

This important feature allows users to add their personal details such as name, age, contact number or mailing address, country, and region. In some applications in the profile, users can fill in the place of work, hobbies, marital status, the presence of children, etc.

User rating

Add an option to your app to check users’ credit scores by simply providing detailed information. Thus, before applying for a loan, the rating will be added to the borrower’s profile, and lenders can decide to grant a loan accordingly.

Collective lending

You can also add the collective lending feature. Thus, users will be able to take a large amount of loan by dividing it into members of the group that takes a collective loan.

Chat bot

This feature will help ensure communication between borrowers and lenders through in-app messaging without exchanging contact details.

Reporting and reminder system

Alerts or in-app notifications will keep users up to date on loan deals available on specific loan types. It is also a handy feature for reminding the borrower of the status of their loan application. Also, this feature will keep lenders up to date with new loan requests received in the application.

Reporting will provide the essential real-time app analytics and help you better understand users, new registrations, number of loans approved, number of transactions completed, and commission earned per month.

Loan restructuring

A loan restructuring is a change in terms of a loan. This feature will help change the loan amount, interest rate, repayment date, etc.

System of feedback and recommendations

This feature will allow users to leave feedback/recommendations about lenders or borrowers. Thus, it will be easier for users to choose a lender/borrower.

Onboarding

Onboarding is one of the most important features of any application. This feature will help users understand how to use the application to quickly find those parts/features/sections/buttons of the application they need in the future.

Integration with various payment systems

Make sure that your application integrates various payment methods: bank cards, PayPal, payment via mobile, etc. This way, you give users a choice.

Work through a representative

Make it possible for users to work in the application through a representative. Representatives can be a company, financial institutions, banks, etc.

EMIs

An equated monthly installment (EMI) is a fixed payment paid by a borrower to a lender on a monthly basis. Each month, EMIs are applied to both interest and principal so that the loan is paid off in total over a predetermined time.

How Much Does it Take to Build a Loan App?

The loan lending app development time depends on such factors as the complexity of the application, the number of features, the complexity of the information architecture, etc.

All projects are individual and it is impossible to name a specific period of time during which loan lending mobile app development is carried out. However, our team has determined the average time it takes for individual loan app development processes to complete:

This information will help you calculate how much time you need approximately to develop your project.

We develop cutting-edge applications

How to Build a Loan App: Summary

The last years felt as though the entire world had come to a halt. However, students worldwide should still pay their school loans, sick people should pay their medical bills, and companies should handle their money as efficiently as possible to stay afloat.

This adds to FinTech applications being a popular financial tool, and many startups and entrepreneurs are currently seeking money lending app development services. Is it possible that you are one of them?