Content

The digital revolution in the insurance industry has created a high demand for the adoption of technology to better satisfy all stakeholders of the insurance lifecycle – policyholders, insurers, and employees. Especially given that the insurance app market is projected to reach $164.13 billion by 2023. As an insurance company or startup, if you’re thinking about insurance mobile app development – your interest is quite apparent.

As a reputable software development vendor, we follow the latest market and technology trends to keep up with the times and help our customers stay on top of the insurance market curve. So, we’ve created an insightful article that covers everything you need to know about insurance app development – from the latest trends and benefits to MVP features and a step-by-step guide based on RewiSoft’s experience. See for yourself!

Insurance mobile app development: market size & statistics in 2023

More and more insurance industry participants are falling for building an insurance app to experience the benefits of the digital revolution firsthand. By introducing future-oriented technology into the insurance lifecycle, insurance market players can optimize all interactions, lower operational costs, increase business value, reduce employee workload, and provide personalized and engaging services to policyholders.

However, not only these reasons create the demand for insurance application development. Here are some key statistics that back up the fact that insurance apps are a go-to idea for businesses:

- The global InsurTech market is expected to reach 10.14 billion by 2025 – indicating that more funds will be attracted to innovations in the InsurTech market during the forecast period

- The vehicle insurance market is expected to reach a market value of USD 1,223.5 billion by 2030 – boosted by the rise in demand for passenger and commercial vehicles

- The global property insurance app market is projected to reach $395.04 billion by 2027 – caused by an increase in the number of accidents and man-made disasters

The impressive growth rate of the insurance market is a strong incentive for many insurance businesses, startups, and venture capital investors to invest in insurance app development. That means any business will be able to drive long-term business growth, open new revenue streams, and reach desired goals faster.

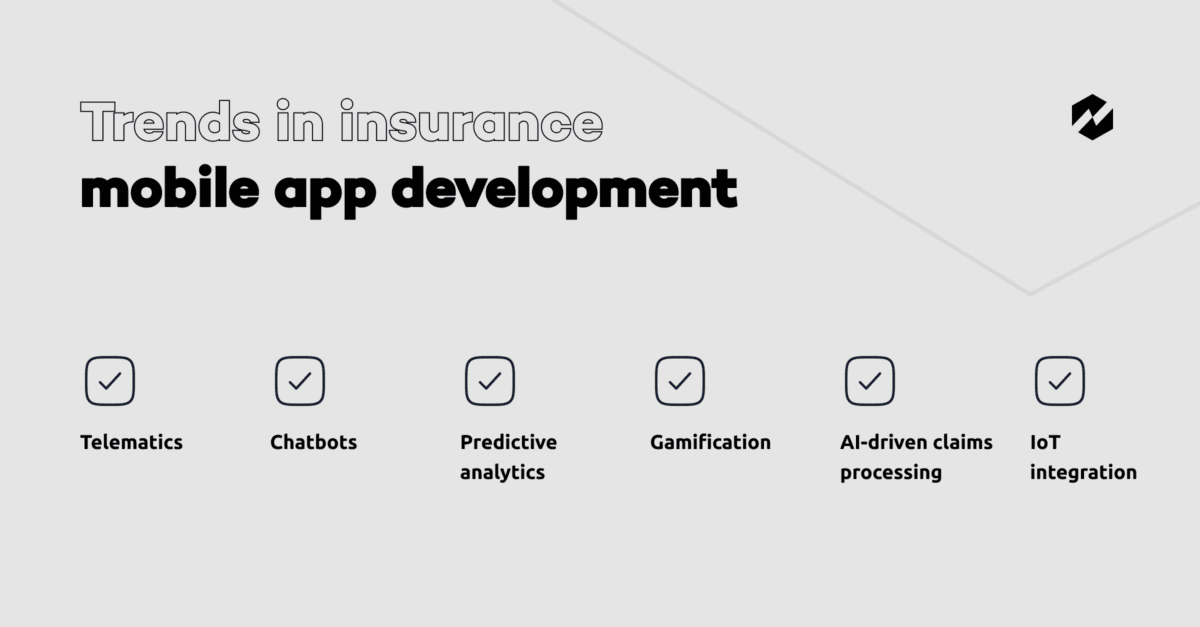

Trends in insurance mobile app development

The technology industry never stands still. So do insurance mobile app development trends that rush towards higher personalization, customer centricity, and processing acceleration. Let’s look at a list of the top-performing trends in the insurance technology industry in 2023.

Telematics

One of the widespread technologies used for vehicle insurance app development is telematics. It utilizes data from a vehicle’s onboard systems to calculate insurance premiums based on real-time driving behavior. Insurance companies enable this technology to offer personalized vehicle insurance policies to drivers based on their behavior behind the wheel.

Chatbots

Another mass-adoption technology is the integration of a chatbot or live chat into insurance applications. Using them, you can provide instant customer service and support through a communication interface. Chatbots can also help with claim filing and processing, improving customer experience.

Predictive analytics

Using predictive analytics, insurance companies can gain deeper insight into how customers are likely to act, identify cancellation risks and fraud risks and offer personalized policies to customers. With predictive modeling, insurers can prepare for future claims and estimate the potential impact on their business.

Gamification

Introducing gamification elements into mobile insurance apps will encourage customers to take action while enjoying using your app. You can outsmart the use of gamification in many ways: educate your customers about a healthy lifestyle, drive a car, or travel safely.

Related reading: How to Build a Gamification Platform in 2023? A Step-by-Step Guide

AI-driven claims processing

AI accelerates the processing of insurance claims while ensuring customers get responses immediately. This acceleration reduces insurers’ workload and allows for processing more claims, prioritizing them, and lowering insurance prices.

IoT integration

Integrating IoT (Internet of Things) in insurance mobile app development enables insurers to monitor and assess risks in real-time and calculate more accurate pricing of risk policies. IoT integration also allows personalizing policies and streamlining claims processes. It also helps insurers to incentivize customers to adopt safe and healthy behaviors.

Why do you need insurance application development?

There are many challenges insurance businesses encounter today, more than a decade ago. The volatility of markets, climate changes, natural disasters (like a powerful earthquake in Turkey), the horrific war in Ukraine, the pandemic, etc., are unpredictable risks, and it becomes harder to assess them properly. However, there are many reasons why you need to step into insurance mobile app development and build a robust and competitive insurance solution that will make your business sustainable.

Lower operational expenses

Providing insurance services through a digital tool significantly optimizes support costs and lower operational expenses. Insurance mobile apps can automate routine tasks and reduce paperwork, enabling staff to focus on more value-added activities. The apps can also enhance customer engagement, loyalty, and retention by implementing customer-centric features while improving the efficiency and profitability of your insurance business.

Automate insurance lifecycle

An insurance application can provide a high level of agent workflow automation and minimization of routine tasks. With its functionality, policyholders can create policies, use underwriting, maintain and terminate them. Policy lifecycle automation also helps insurance companies personalize customer interactions by introducing customized rates, discounts, and new sales offers.

Study customer data in real-time

Many types of data insurance apps can quickly analyze. For example, identity data (e.g., name, phone number, links to social media profiles, email, etc.), quantitative data (e.g., bank account details, credit score, frequency of payments, etc.), descriptive data (e.g., educational background, property details, car ownership, etc.) and qualitative data, like behavioral customers’ details. All this information can be used to improve the service and provide personalized insurance offerings.

Increase user engagement

User-friendly interfaces, personalized experiences, real-time updates, and 24/7 customer support are all proven ways to increase user engagement. Insurance mobile apps can make a good impression by offering wide-ranging functionality to customers, including features like policy management, claims filing, in-app payments, and discounts for healthy behaviors. All mentioned will encourage users to stay active and engaged with the app.

Grow user reach

Providing good customer service is always the way to get positive feedback and attract more customers. By offering mobile-friendly services, insurance companies can tap into the growing number of mobile app users and reach a broader audience that may not have access to traditional insurance channels. You can also advertise your mobile insurance app in similar apps to target an even bigger audience.

Boost sales and efficiency

We’re convinced insurance businesses should invest in insurance application development to offer a more convenient and accessible way for customers to purchase insurance policies, file claims, and receive support. What’s more, since insurance apps can provide real-time data and analytics, it can help businesses identify areas for improvement and optimize their operations. As a result, mobile insurance apps enable companies to retain existing customers and attract new ones, leading to increased sales and productivity.

Insurance app development: 6 main consumer-centric app types & features

We divide all insurance app solutions into two categories: apps for customers (policyholders) and apps for insurance companies. Most often, insurance businesses need to develop both types of insurance apps accessible through a mobile device. Below, we’d like to list the most popular types of consumer-centric app and their features that are important to consider for insurance mobile app development.

Vehicle insurance

Vehicle or car insurance apps provide a convenient way for customers to manage their policies, file claims on the spot, take pictures of the accident and receive a repair estimate and updates on their coverage in real-time.

Some popular examples of vehicle insurance apps include GEICO Mobile, Progressive, and State Farm. These apps allow users to easily access their policies, report claims, and even obtain quotes for new coverage.

Important features specific to vehicle insurance app type to include are:

- Maps and geolocation

- Live chat support

- IoT integrations (like sensor-led tracking)

Read Also: How to Build a Taxi Booking App in 2023 and Succeed? [ Complete Guide]

Health insurance

Health insurance apps can be beneficial to policyholders in several ways. They allow policyholders to easily access information about their health insurance, book appointments, and find suitable health plans, doctors with the best rates, and pharmacies with the lowest prices.

For example, we needed to develop a well-being platform for remote patient monitoring and care management for one of our NDA cases. The platform allows synchronizing of patients’ medical insurance.

Important features specific to health insurance app type to include are:

- Telemedicine integration

- Book appointments

- Search for finding the right specialty and doctors

- Symptom checker

- Pharmacy search

Read Also: A Step-by-Step Guide to Healthcare Web Application Development

Travel insurance

Travel insurance apps help policyholders minimize different travel risks that may occur while traveling. Some common benefits of travel insurance apps include coverage for medical emergencies, trip cancellations or interruptions, lost or stolen baggage, and flight delays or cancellations.

Two popular travel insurance apps are Allianz TravelSmart, and the Travel Insured app, which offers convenient features for managing policies, filing claims, and accessing emergency travel assistance.

Important features specific to travel insurance app type to include are:

- Travel guides

- Service listings

- In-app map

- In-app chat

- Claims tracker

- Translator

Read Also: Detailed Guide To Hotel Booking Application Development

Property insurance

This app works best for insuring real estate, expensive equipment, artwork, jewelry, and other properties by allowing you to choose a policy through an app, file claims, receive maintenance reminders, and track property for damages, leaks, and breakdowns.

Lemonade and State Farm are popular property insurance apps that offer policyholders easy access to manage their policies, file claims, and access resources to manage their homes and properties.

Important features specific to property insurance app type to include are:

- Reminders for periodic maintenance of assets

- Telematics to track leakages, breakdowns, etc

- Push notifications to optimize the consumption of gas, power, and water

Read Also: How to Develop Real Estate Management Software? [Guide, Best Practises, Pitfalls]

Life insurance

Such apps facilitate all routine processes by helping customers choose the right policy, review terms and conditions, make online payments, calculate the interest rate, and contact the support bot through the app.

Policygenius and Ethos are popular life insurance apps that offer users a convenient way to compare policies and purchase life insurance that fits their needs. Both apps also provide resources and tools to help users make informed decisions about coverage.

Important features specific to life insurance app type to include are:

- Policyholder profile

- List of Policies

- Usage of policies

- Geolocation

- On-demand insurance activation and deactivation

Read Also: Start to Develop a Hospital Management System: Steps, Price, Features

Business insurance

Such apps safeguard significant business investments against huge risks. Using business insurance applications, users can choose the right package, easily purchase a policy and minimize losses by quickly settling an insured event.

Next Insurance and Hiscox are popular business insurance apps that provide access to various policies and resources to help business owners manage risks and protect their investments.

Important features specific to business insurance app type to include are:

- Quick quotes

- Robust authentication

- Intuitive search

- Automated claims processing

Read Also: How To Create a Minimum Viable Product (MVP)? [Startup Case Studies]

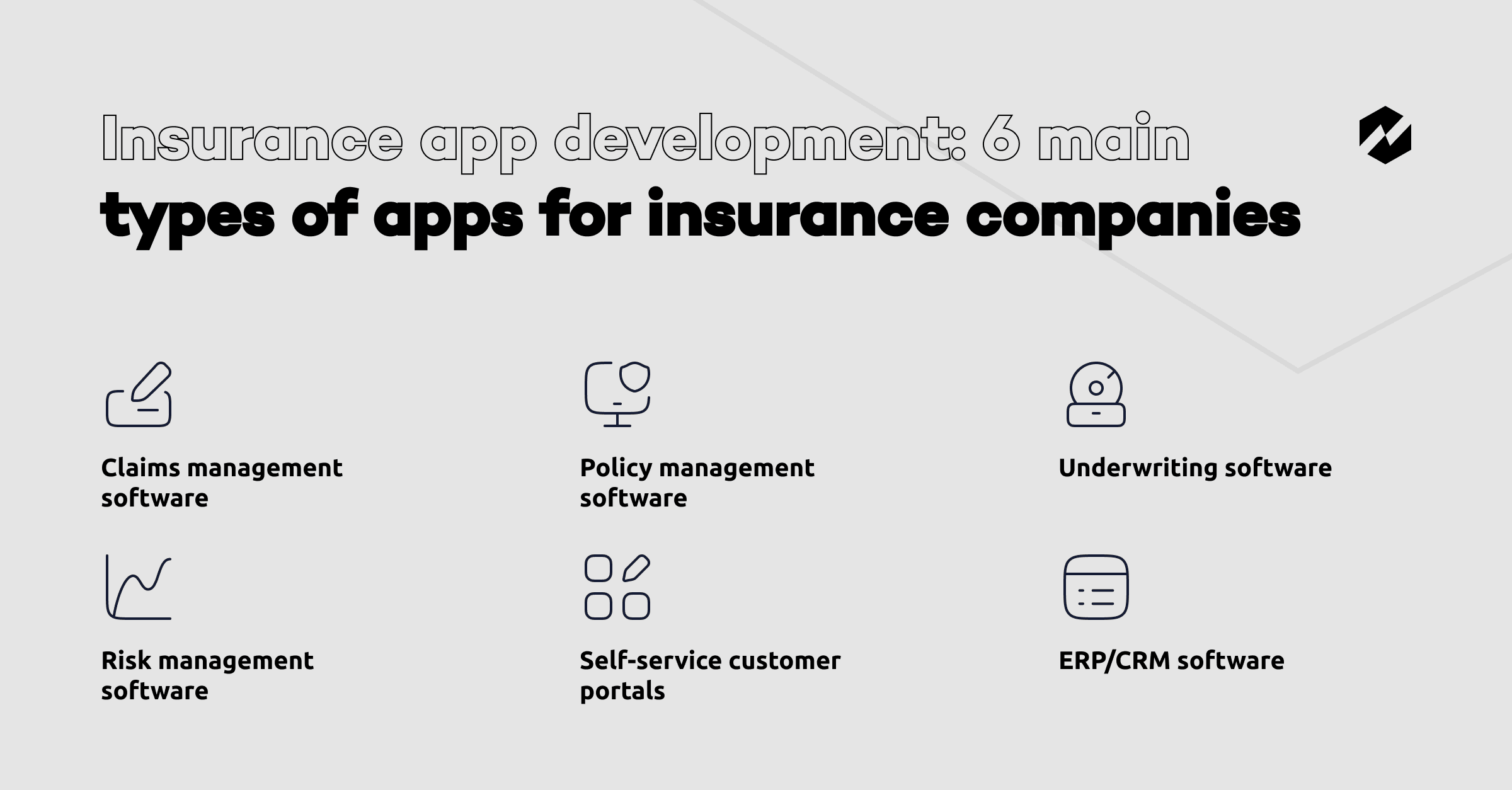

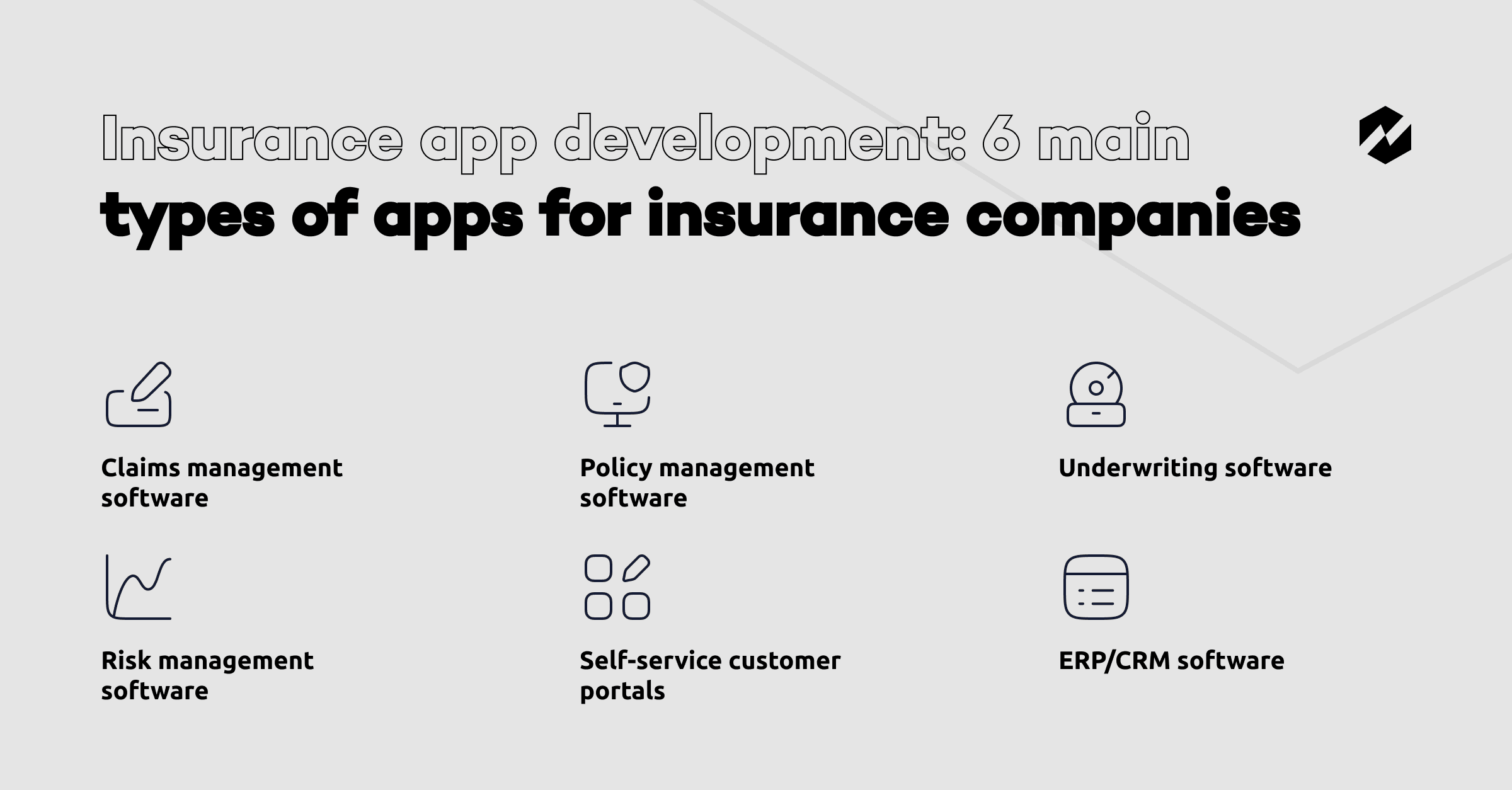

Insurance app development: 6 main types of apps for insurance companies

Below, we list the most popular types of apps for insurance companies important to consider to find the best one for your business.

Claims management software

Claims management software streamlines agent workflow, and claims processing, reduces paperwork and improves overall efficiency for insurance companies. Claims management software is also a valuable tool that helps agents easily identify fraudulent claims and reduce costs in the long run. Thus, the software can save time and money, leading to faster claim resolution and increased customer satisfaction.

Policy management software

Policy management software can streamline policy administration processes, help insurance companies manage policies more effectively, and reduce costs for policy processing. RewiSoft offers insurance policy management software development services that feature built-in AI algorithms. These algorithms help companies reduce insurance risks and perform reinsurance operations more efficiently.

Risk management software

Building risk management software can help insurance companies identify, analyze, and mitigate potential risks on the spot. This software can improve the accuracy of risk assessments, reduce operating costs, and provides better risk management services to policyholders. Such applications can help insurance companies make better decisions and minimize losses.

Underwriting software

Underwriting is a critical process that involves assessing the risks that an organization bears when insuring the health or property of the insured. Building underwriting software can help you accurately assess risks and avoid human error.

ERP/CRM software

Insurance apps with integrated CRM and ERP systems can significantly optimize an insurance workflow. With insurance CRM solutions, you will make it easier for insurance agents and brokers to organize communication with policyholders and automate specific activities. With ERP systems, you can store and process large amounts of data, implement a centralized database, control all data, and use it for high-level analysis.

Self-service customer portals

Creating customer self-service portals allow insurance companies to reduce the burden on insurance agents and force customers to manage policies and other transactions on the go. At RewiSoft, we develop customer portals with direct access to the knowledge base where users can find any information they need faster.

To choose the proper type for your upcoming insurance solution, RewiSoft offers insurance software development services!

We will create a customized and user-friendly insurance software solution and assist you in proper design and development every step of the way.

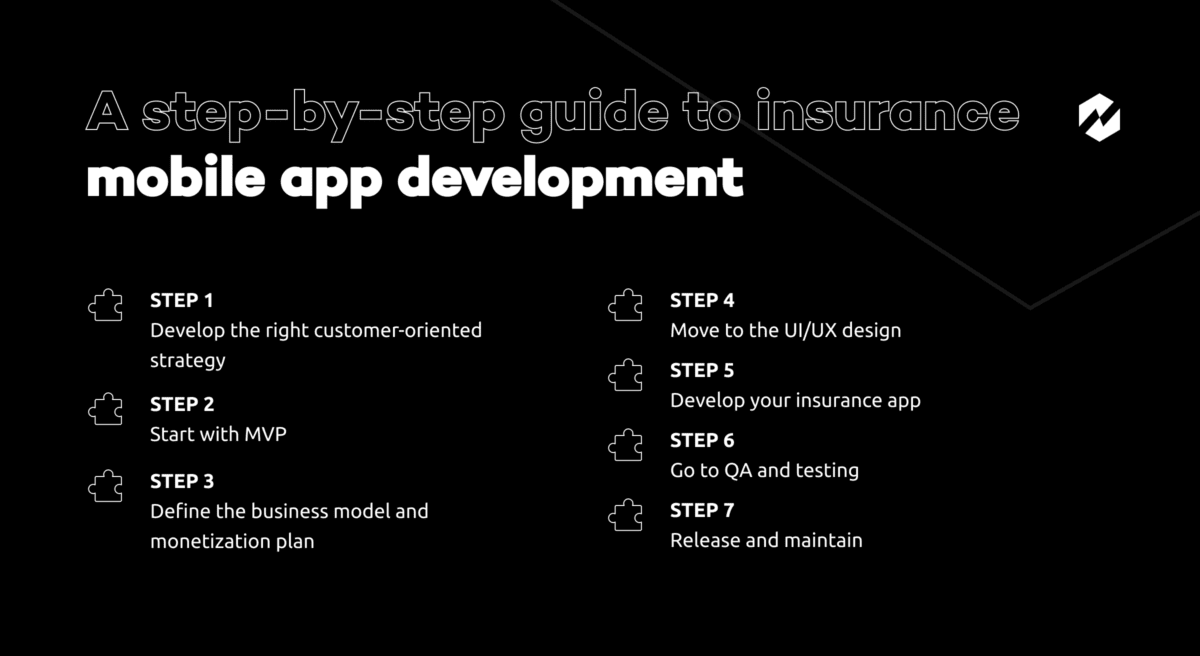

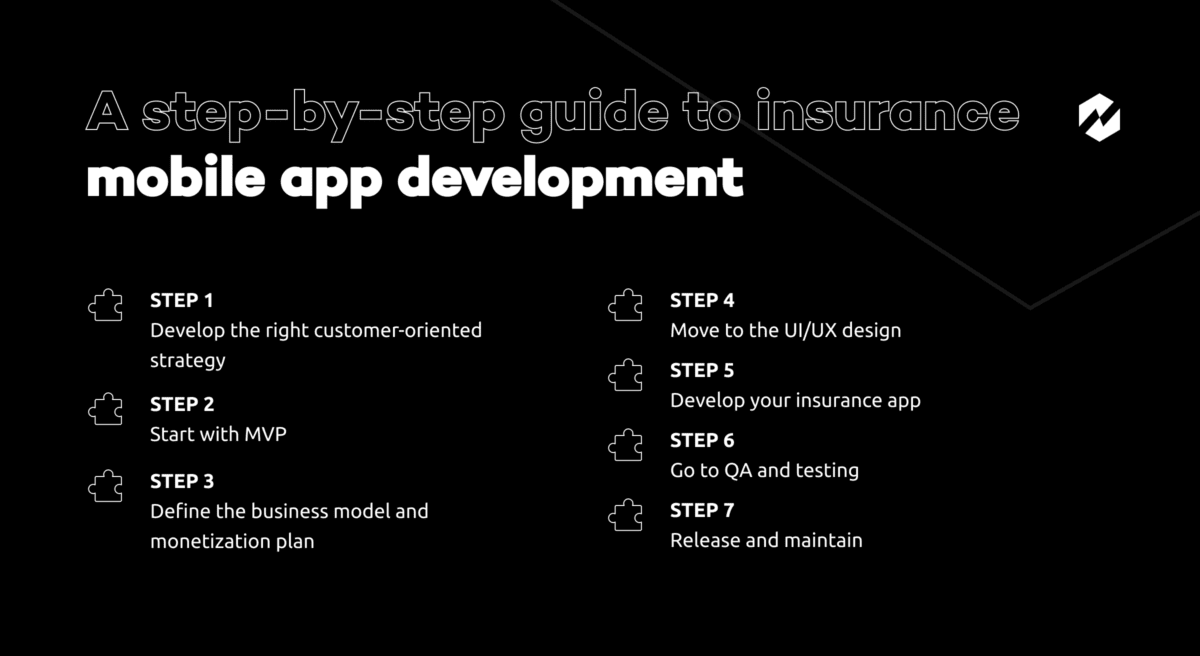

A step-by-step guide to insurance mobile app development

Insurance mobile app development requires a profound knowledge of all the peculiarities of the insurance industry. Having solid experience in this field, we’ve compiled a step-by-step guide to develop an insurance app that enhances customer experience, increases efficiency, and gives you a competitive advantage in the market.

Step 1. Develop the right customer-oriented strategy

Like in any other app, the first step in insurance mobile app development is in-depth research to analyze the target audience, define the primary business goals, and create a long-term strategy to achieve them. Shaping the right customer-oriented approach is essential to understand why your policyholders need your app and how you can benefit from it.

For example, in our White Label Telemedicine Platform case, part of our customer-oriented strategy was integrating medical insurance into the well-being platform since it’s vital for ensuring access to affordable and high-quality healthcare, reduced healthcare costs, and improved health outcomes.

So, to create an effective strategy and meet all business goals, at RewiSoft, we perform the following tasks for insurance application development:

- Research the market: We collect information about similar types of insurance apps that exist on the market. Our BAs also analyze the latest trends and innovations in the insurance industry to identify gaps in the market and develop features that will make your app stand out.

- Define and analyze your target audience: We study the preferences and behavior of your target audience, identify their pain points and decide how to attract and motivate them to download your application.

- Conduct competitor research: We study similar offers in the insurance market and explore the strengths and weaknesses of direct competitors to find a better solution to solve the same problems for users.

- Create a unique value proposition (UVP): We create a value offer that aligns with your core business goals based on research findings.

- Perform user research: During this step, we help surveys and interviews with a focus group to identify user needs and preferences to create a general user persona profile.

- Develop user personas: Based on research results, we create a detailed user profile to reflect the user segment we want to reach (e.g., doctors, admins, and patients, as in our White Label Telemedicine Platform project).

- Create a list of must-have functionality. We identify and prioritize the essential features your app should have based on user needs and business goals.

- Compile technical documentation: We create detailed documentation that contains all our customer’s requirements, tech stacks, the scope of work, team structure, and project milestones.

- Estimate project timelines and costs. We perform a detailed time and cost analysis to set the required budget for the development, marketing, and maintenance processes.

Step 2. Define the business model and monetization plan

To define a working business model, you must conduct preliminary market research and explore traditional monetization options. This way, you can determine how your insurance business will generate profits from developing a mobile app.

There are four monetization options you can choose from:

- Advertising model. Using this model, you can generate income by providing your application to other companies as an advertising platform. You earn a specific commission whenever a user clicks on the advertised link.

- Subscription model. Insurance companies implement a subscription-based model for using premium offerings. These offerings may include premium listings or other services integrated with the platform. The payment is usually made monthly or yearly (for example, $15 monthly for a subscription).

- Commission-based model. This model is more suitable for aggregator applications that can compare insurance plans, match policies, and search for the right insurance companies. Both users and insurance companies pay a commission to an app.

- Referral model. By incentivizing users to share an insurance app with friends for a reward, this model allows you to generate revenue by attracting new customers and increasing application downloads.

At RewiSoft, we recommend balancing the desire to acquire users with the desire to make money. Depending on the monetization method, you can start earning immediately or gradually increase your audience and receive money after a certain period. Also, you can combine several monetization models and test several versions at once to define the best working for you.

Step 3. Start with MVP

Whether you’re a startup or an established insurance company, we recommend starting small if you launch a mobile insurance app from scratch to avoid further risks and budget overruns.

By creating a minimum viable product, you will need a limited feature set and less budget and time to release your first version of an app to understand whether it induces users’ interest. That means you can launch your app in just 2-4 months (instead of 6+) and start collecting feedback.

By analyzing feedback, we refine your product to suit the target audience’s interests most and avoid implementing redundant functionality. It is an iterative process that involves collecting ongoing user feedback and implementing updates to your design and features.

However, with an experienced insurance software development provider, this task is a piece of cake. Find out more about our service offering: MVP development services!

Recommended reading: How To Create a Minimum Viable Product (MVP)? [Startup Case Studies]

Step 4. Move to the UI/UX design

At this stage, our design team uses wireframing or prototyping tools to create a basic version of your insurance app to test with users. The UI/UX design phase is required by default to show how the application will look and work and resolve any inconsistencies before the development phase.

At RewiSoft, this process works as follows:

- Assigning UI/UX designers to your project: We assign 2+ UI/UX designers with a solid experience in the insurance niche.

- UI/UX research: They study the target users, their pain points, needs, and goals.

- User flows and customer journey mapping: Our designers identify user flows and create customer journey maps to visualize how your users will engage with your brand, service, and product and reach their primary goal: buy your insurance services.

- Information architecture: Our designers create a clear information architecture that organizes content and features logically and intuitively. That helps us develop a clear and concise navigation structure.

- Wireframing: Based on the information collected, we start visualizing the layout and functionality of the app. That is an intermediate step to refine the design before moving on to more detailed prototypes.

- Prototyping: We create interactive prototypes (i.e., clickable design) to test the functionality and usability of the insurance app.

- Visual design: We can create mood boards, UI kits, and design systems that contain chosen color palettes, logos, animations, typography, and graphic elements such as icons and images. That is a guideline for our designers to develop a visual design in a consistent style that aligns with the brand identity and is visually appealing to users.

- Usability testing: Several prototypes are submitted for testing with real users. It helps us identify usability issues and make the necessary changes before investing too much time and money into development. Moreover, RewiSoft has an in-house UX Lab, where we use an Eye Tracker tool to track users’ behavior patterns, decide how to meet usability gaps, and increase conversion.

A successful UI/UX design phase for an insurance application development involves a user-centric design approach focusing on creating a seamless and intuitive user experience.

Looking for professional mobile design help? Find out how you can benefit from our mobile app design services!

Step 5. Develop your insurance app

This stage entails turning the designed screens into a working insurance app. The insurance application development phase includes careful planning, coding, testing, and deployment to ensure the application is functional, reliable, and meets user needs.

The RewiSoft team follows the below steps during the development stage of creating an insurance app:

- Choose the right platform: We choose the appropriate platform for your mobile app, whether iOS, Android or both. The choice will depend on your target audience’s preferences and the devices they will most likely use.

- Define the app’s architecture: We define the app’s architecture, including the design of the app’s user interface, its database structure, and its back-end services. That helps us develop the app in a structured and organized way.

- Plan sprints: We assign (2+) mobile app developers, plan the scope of work for each iteration that lasts 2-4 weeks, and define priorities and task sequences to meet the expected results on time.

- Develop the front end: Our front-enders develop the app’s front end, including designing the app’s screens, navigation, and interactions. Read more about our Front-end development services!

- Build the back end: Our back-enders build the app’s back end, including the server-side infrastructure, APIs, and database. Read more about our Back-end development services!

- Integrate third-party services: Depending on the need, we integrate third-party services, such as payment gateways, social media platforms, and analytics tools, into the insurance app.

- Testing: Here, our testers come into play to conduct comprehensive testing to ensure the app is bug-free and performs well. That includes unit testing, regression testing, integration testing, and end-to-end testing.

- Delivery. Our project managers monitor the developers’ work to ensure the project is completed on time and with the expected quality.

Step 6. QA and testing

Once the development stage is over, we conduct multiple tests to check for vulnerabilities and bugs and minimize potential reworks later. Thus, we thoroughly test your app for usability, bugs, compatibility, security, and the level of satisfaction of insurers and policyholders. We put the results in bug reports and assign developers to fine-tune the application and make the necessary improvements.

Step 7. Release and maintain

The release of your insurance app is not the endpoint of insurance app development. In addition to deploying your app to an appropriate app store or distribution platform such as the Apple App Store or Google Play Store, you must maintain your app regularly. Moreover, since the insurance market is changing rapidly, you may require adding new features and constantly finding ways to attract more users.

At RewiSoft, we provide ongoing maintenance and support to ensure the app runs smoothly and is up-to-date with the latest security patches and feature updates. So, if you need any help – contact us!

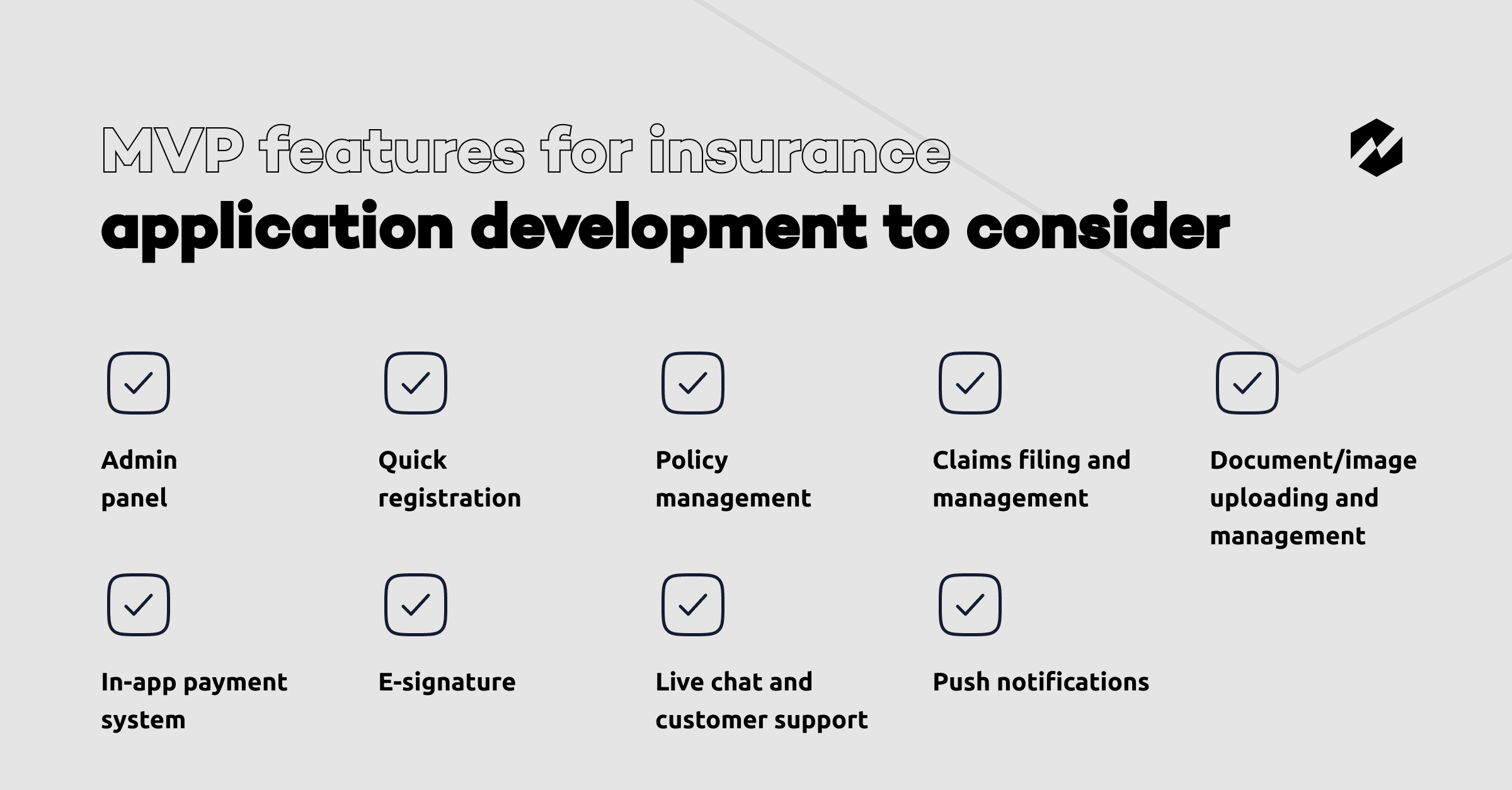

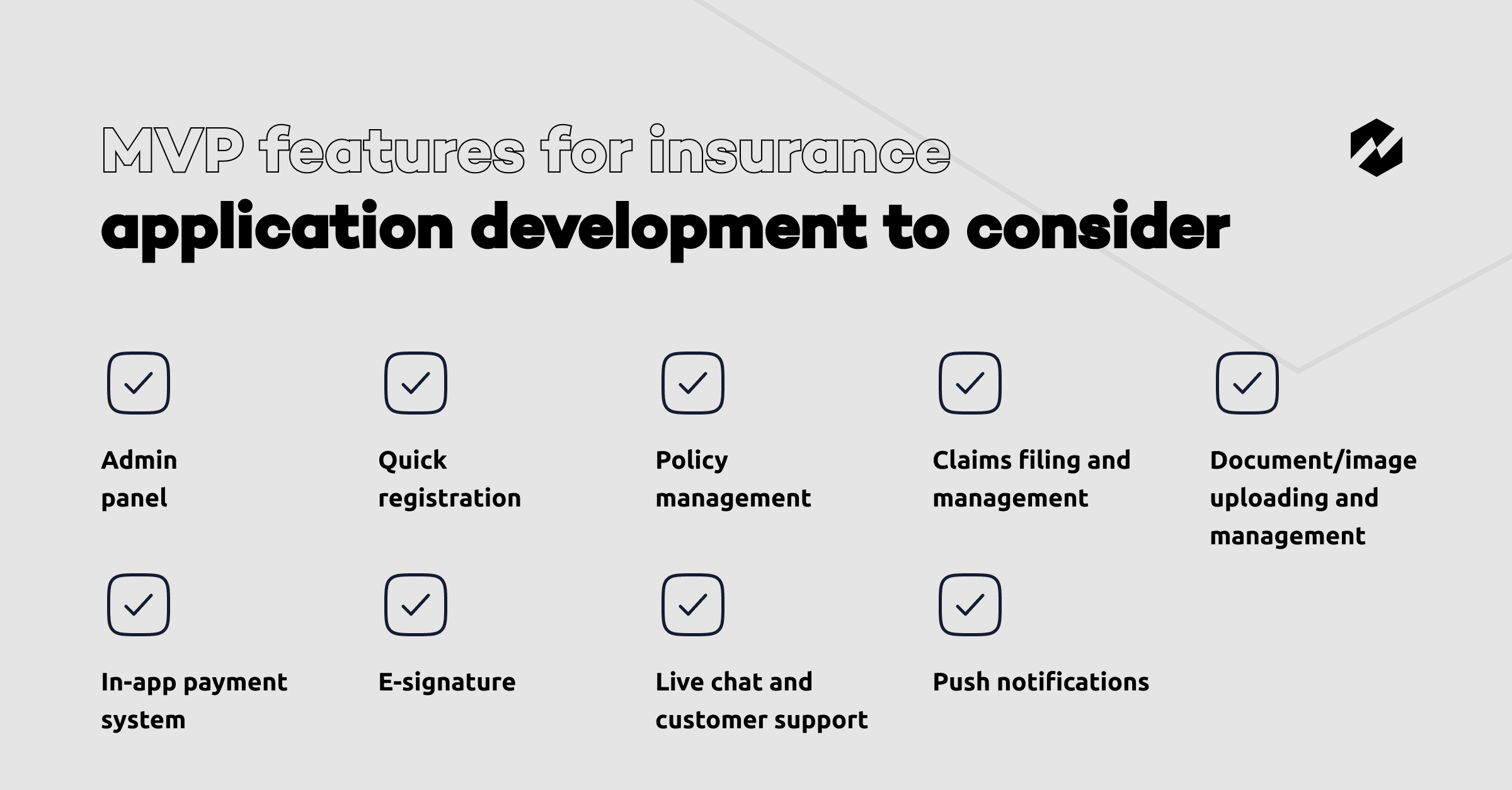

MVP features for insurance application development to consider

Regardless of the type of insurance application, we implement certain MVP features during insurance mobile app development to understand whether the product is needed and whether your app idea attracts end users.

Admin panel

The admin panel is a dashboard for viewing and managing information about customers, insurance agents, and company operations. When designing it, it’s best to make it clear and simplistic by adding only relevant information to the dashboard. You should also invest in the latest security protocols and ensure robust data protection measures since agents deal with sensitive payment and customer information.

Quick registration

The registration feature allows users to create their accounts and access their policies. The registration process should be user-friendly and secure, allowing users to register their insurance policies and digital signature. The information to collect during registration includes the user’s name, email address, phone number, and password.

Additionally, verifying the user’s identity through email or SMS confirmation is essential. Our developers use third-party verification services like Onfido or Jumio to streamline the verification process.

Policy management

It allows policyholders to view and manage their policies, premiums, and claims. Best practices for policy management development include incorporating AI algorithms to analyze customer behavior and provide personalized policy recommendations that suit their budget and interests.

Document/image uploading and management

Users should be able to upload and access relevant documents in one click (e.g., ID cards, driver’s licenses, or insurance policies) and high-quality images (like submitting proofs of when and how the insured event occurred). As a mobile insurance app provider, you should allow your customers to upload, access, filter, and review all the documents and policies they need on the go.

Claims filing and management

Your insurance solution should allow customers to create, submit and track their claims. The best practice when developing this feature is allowing users to submit claims by straightforward in-app instructions. In this way, we make the user experience intuitive and smooth, allowing the user to file a claim on a single page easily.

In-app payment system

Integration of a robust in-app payment system is a must-have feature for insurance app development. When implementing an in-app payment system, ensure support for multiple payment methods (e.g., credit/debit cards, bank transfers, mobile wallets, and online payment platforms such as PayPal or Stripe). However, the choice of specific payment methods will depend on the target market and the app’s integration capabilities.

E-signature

Introducing an e-signature option to your mobile app will allow insurance companies to sign documentation easily and securely. The best practice we use to implement this feature is to integrate biometric hand signatures, mouse and stylus input, and scanned images of handwritten signatures.

Live chat and customer support

Providing instant and secure communication between policyholders and insurance agents is essential. Messaging option will allow both parties to communicate on bargain details in a matter of a few minutes. It also allows customers to easily connect with service staff to discuss their policies, claims, and premiums and solve problems.

Push notifications

By integrating a smart notification system into a mobile app, you will be able to get your customers notified about the progress of claims processing, payment status, new personalized offers, etc. Sending regular push notifications to your customers will increase user engagement and significantly improve the overall experience of the platform.

Tech requirements for insurance app development

Any product owner and insurance company takes a risk by investing in insurance application development. So, exploring your future insurance app’s required tech characteristics is vital to ensure its success. Consider the technical requirements below to create a mobile insurance application with the latest technology, strong protection, legal compliance, and decent quality.

Advanced technologies

Introducing cutting-edge technologies into your insurance app can significantly maximize operational efficiency and deliver a superior customer experience.

Our team is proficient in all core modern technologies, so we have no limitations regarding our customer’s requests for insurance mobile app development. Below, we’d like to provide a brief overview of advanced technologies that can make your app stand out.

- ML and AI algorithms – for real-time data analytics, risk assessment, personalizing the user experience, automating underwriting procedures, and optimizing claims turnaround cycles

- AI-powered chatbot – for improved and quick customer service

- Big data – for enhanced decision-making, user behavior analysis, risk prediction, and improving underwriting accuracy

- Blockchain – to secure transactions, avoid fraud, increase transparency, and streamline the claims process

- IoT – for secure data collection and sharing, claims processing, and customer engagement

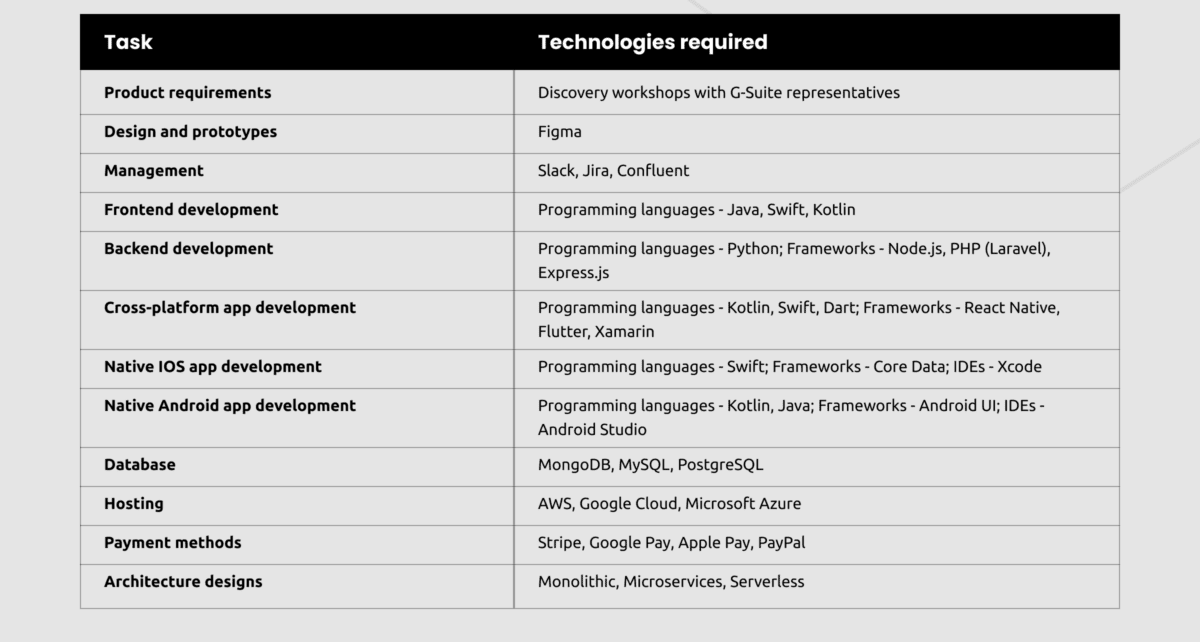

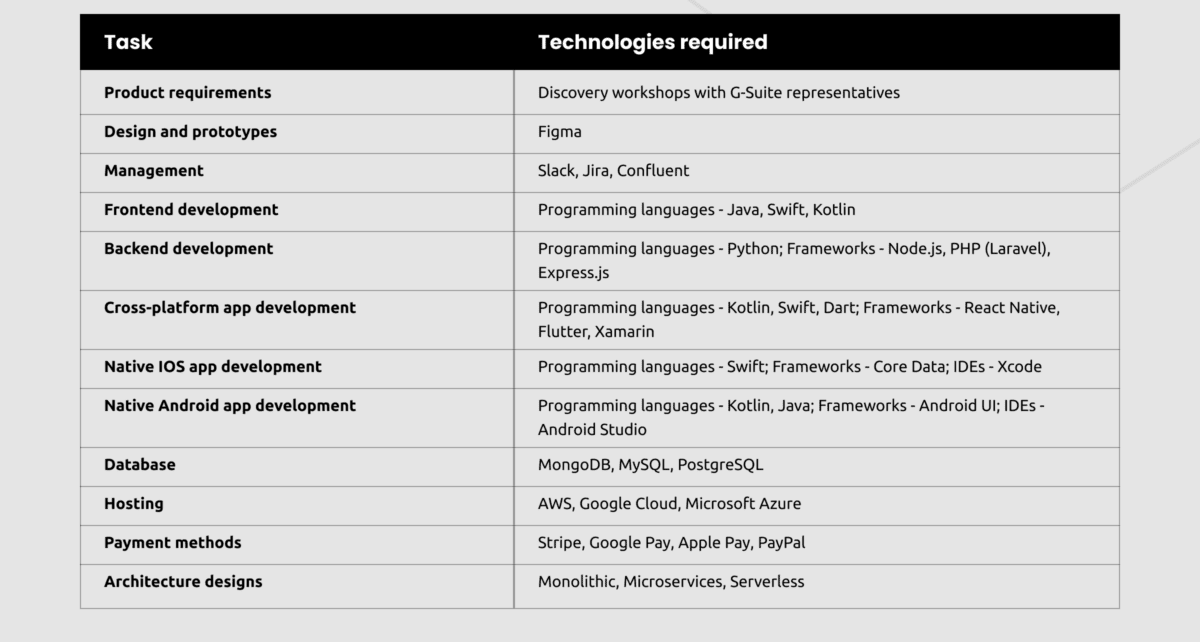

Tech stack

The choice of tech stack will depend on the development approach (native, hybrid, or cross-platform) of your mobile insurance app, your project goals and business requirements, as well as factors like development timelines, budget, and available expertise of your development team. However, this choice should be wise since it will determine your mobile app’s stability, performance, flexibility, security, and maintenance.

For insurance mobile app development, we usually prioritize the following tech stack:

Security measures

Security comes first when it comes to working with users’ data. Security measures are essential for any application, especially for insurance services that allow storing confidential information and making online payments. So, every insurance business should create a combination of approaches and tools to protect customers’ data and decrease the number of cybersecurity threats.

At RewiSoft, we recommend following the security best practices below to ensure a secure and compliant application. Some of them are:

- Two-factor authentication (2FA) and biometric authentication for an added layer of security

- Data encryption to protect all user’s sensitive data and personally identifiable information (PII) during storage and transmission

- Secure data transmission by using encryption protocols such as HTTPS, SSL, and TLS to ensure that data transmitted between the app and servers is secure

- Payment gateway protection

- Regular security audits to protect sensitive user data

- Built-in fraud detection algorithms

- Conducting penetration tests

- Creating workable risk mitigation plans

- Implementing blockchain to secure transactions

Legal compliances

It’s vital to consider legal compliances to ensure your app is compliant and adheres to legal compliance laws. Regulations vary by jurisdiction, so your application must comply with insurance industry standards in the location where your application will operate. Otherwise, non-compliance will result in civil, financial, or even criminal sanctions for insurance businesses.

For example, in the United States, insurance apps must adhere to state insurance department regulations, HIPAA regulations, and other data privacy and security regulations.

In the European Union, insurance apps must comply with the General Data Protection Regulation (GDPR), the Insurance Distribution Directive (IDD), and other national insurance regulations.

The app should also comply with various industry standards, such as OWASP (for app security), PCI DSS (when dealing with cards), and SOC 2 (standards for managing customers’ data.)

RewiSoft’s experience in insurance mobile app development

RewiSoft provides insurance software development services across different industries. Whether you’re building a custom insurance solution or integrating insurance features into your existing product, RewiSoft is ready to create a powerful solution for your business.

One of the latest projects we were engaged in was a platform for remote patient monitoring and care management

Our Customer is a healthcare technology company that provides remote healthcare services. RewiSoft was challenged to build a new platform for remote patient health monitoring with the ability to synchronize patients’ medical insurance.

So, our goal was not only to help healthcare organizations and hospitals provide a tool that allows remote monitoring and care management but also to enhance the overall patient experience, giving them direct access to synchronizing insurance via the platform.

We carefully analyzed all the requirements of the Customer and arranged a brainstorming session to determine the main challenges that we needed to solve:

- Enhance the patient experience and support a variety of healthcare facilities

- Provide rich healthcare functionality, including appointment scheduling, medication reminders, telemedicine consultations, and EHRs integration

- Provide the fastest possible data exchange for constant and accurate insurance synchronization.

- Add policy management functionality

The scope of features we’ve developed:

- Registration (log in by entering their emails and password or using the social media option)

- Remote and secure messaging for hassle-free communication between doctors and patients

- Admin panel

- Patient portal

- Doctor dashboard

- Customized care plans generation

- Remote patient monitoring

- Care management

- Appointment scheduling

- Medication reminders

- Telemedicine consultations

- Real-time alerts

- Insurance synchronization

- Policy management

As a result, we created an all-in-one feature-rich mobile platform for remote patient monitoring and care delivery with insurance policy integration. By accessing the platform, patients can quickly get information about health insurance, understand what it covers, and which plans are best for them. Our Customer achieved a 30% increase in online quotes for healthcare policies.

Are you interested in developing an insurance mobile app but don’t know where to start? Look no further! Tell us about your project now!

How much does it cost to develop an insurance app?

Regarding detailed project estimates, there is no one-size-fits-all option to estimate insurance mobile app development. However, to give you more clarity on the price of a mobile insurance app, you should understand the following factors will heavily affect the final cost:

- Complexity and size of the project

- Unique business goals

- Scope of functionality

- Necessary third-party integrations

- Tech stack

- Development platform (IOS, Android, or cross-platform)

- Required app’s time to market

- Developers’ rate

Regarding the last factor, look at the statistics below, where you can find the range of developers’ rates by region.

- North America: $150-$250 per hour

- Western Europe: $100-$200 per hour

- Eastern Europe: $50-$150 per hour

- Asia: $25-$100 per hour

Below, we also would like to share a rough estimate of the cost range for insurance mobile app development in Eastern European countries based on the development stage:

- Discovery and planning stage: $5,000 – $15,000

- UI/UX design stage: $5,000 – $25,000

- Front-end and back-end development stage: $20,000 – $80,000

- Integration and testing stage: $5,000 – $15,000

- Deployment and maintenance stage: $5,000 – $20,000 per year

At RewiSoft, we recommend starting with MVP development since it’s the fastest and budget-friendly way to develop basic features, validate your app idea, and get first customers. At RewiSoft the price of MVP solution starts from $20,000.

Creating an MVP for native or cross-platform will range from $20,000 and will go up depending on the functionality needed. Developing a full-featured insurance app will fall from $30,000, while a full-fledged insurance app with AI can cost $50,000+.

we will create the best proposal and help you select the most cost-effective model to suit your needs

Insurance application development: Summary

With the rise of mobile usage, having an app can help insurance companies reach a wider audience and improve customer engagement. In addition to the tremendous benefits of mobile insurance apps, key statistics suggest that more funds will be attracted to innovations in the InsurTech market. So, if you want to experience the benefits of digital innovations in full swing, you should partner with the right insurance mobile app development company.

RewiSoft is ready to become your reliable partner in helping you to define a profitable long-term strategy, build a custom insurance mobile app with customer-focused functionality and exceptional UI/UX design, and implement all your business and technical needs into life in no time. Feel free to contact us!