Content

Personal financial app development is becoming increasingly popular as more people look to optimize their resources, monitor expenses, and ensure financial stability.

Financial institutions hold significant potential for business owners and investors. According to Allied Market Research, the personal finance software market is projected to reach $1,576.86 million by 2027, growing at a CAGR of 5.7% from 2020 to 2027. These figures highlight the steady growth of the global personal finance management market, sparking optimism and excitement for future business opportunities.

In this article, we’ll guide you through:

- The specific stages of the financial app development process

- Various types of personal fintech apps

- Practical cases from RewiSoft

- A comprehensive list of key features

- The costs associated with building a profitable fintech solution

Understanding these aspects will help you navigate the dynamic landscape of personal financial app development in 2024 and the following years.

We offer full-service custom development

What is a Personal financial app?

A personal financial app streamlines financial activity management and offers valuable analytical insights to help users manage their budgets effectively.

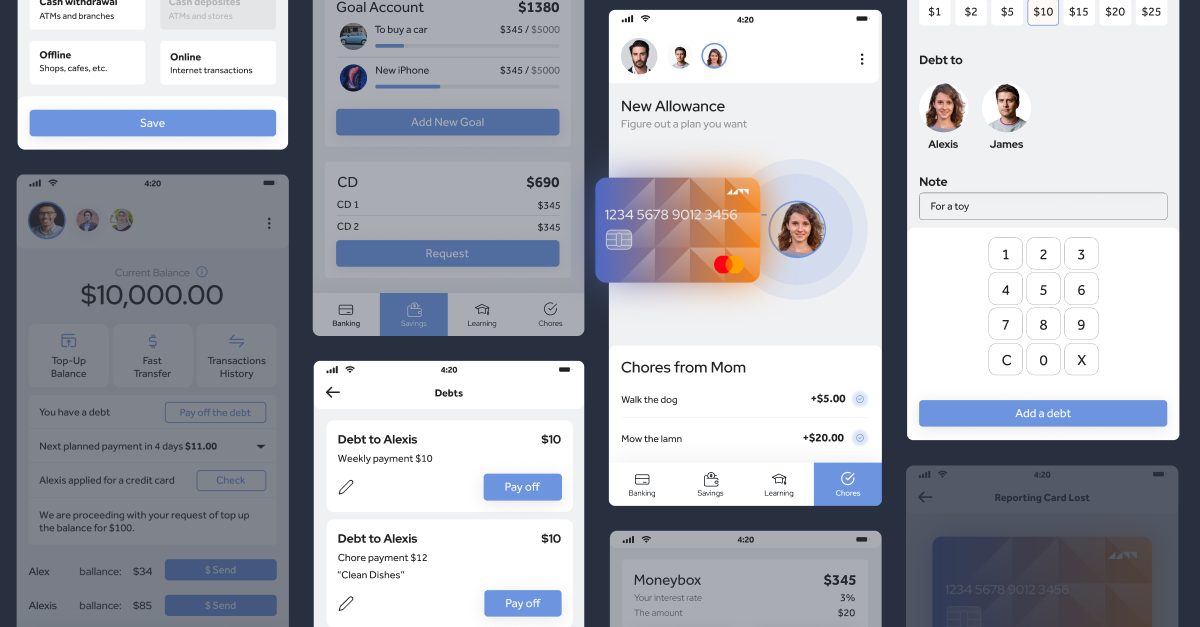

Depending on your target audience’s needs, personal fintech apps can provide essential features such as:

- Smart budgeting and accounting

- Money management insights

- Financial reports

- Monitoring of spending and earnings

- Secure online transactions and payments

- Enhanced financial literacy

- Informed investment decisions

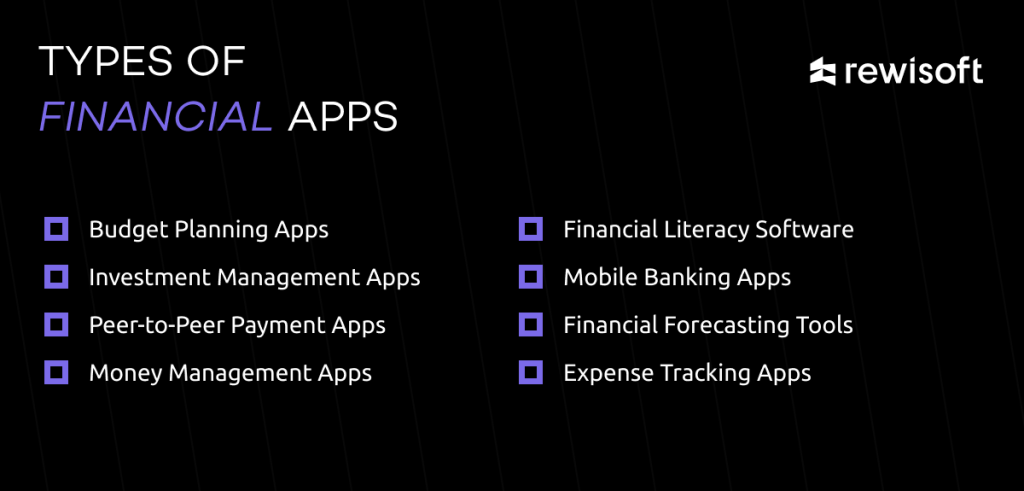

Types of Financial Applications

- Budget Planners: These budgeting apps help users meet their financial goals by planning monthly cash flow, allowing them to set spending limits and allocate savings effectively.

- Investment Apps: These apps enable you to grow your wealth through micro-investments without requiring extensive knowledge of investment rules, instilling confidence in your financial decisions.

- Peer-to-Peer Payment Apps: These applications facilitate seamless payments for services and products, allowing businesses to receive payments directly to their accounts.

- Money Management Apps: These solutions help users manage cash flow by tracking and categorizing expenses, offering a clear overview of earnings and spending for better financial planning.

- Financial Management Apps: These apps aim to improve financial literacy, help users manage their money effectively, and offer advice on optimizing savings.

- Banking Apps: Online banking apps that facilitate a wide range of financial transactions and services, allowing users to manage their bank accounts, conduct transactions, and monitor their finances directly from their mobile devices. For instance, we developed AWSM Bank, a Neobank application for kids. It allows parents to control transactions, teach financial literacy, and ensure the utmost security of their child’s financial information, providing peace of mind.

- Financial Forecasting Apps: These Apps use AI to analyze cash flow and financial goals, providing actionable recommendations to help businesses plan future profits and expenses.

- Spending Tracker Apps: These apps track expenses manually or by linking to digital bank accounts, helping users understand and balance their spending habits.

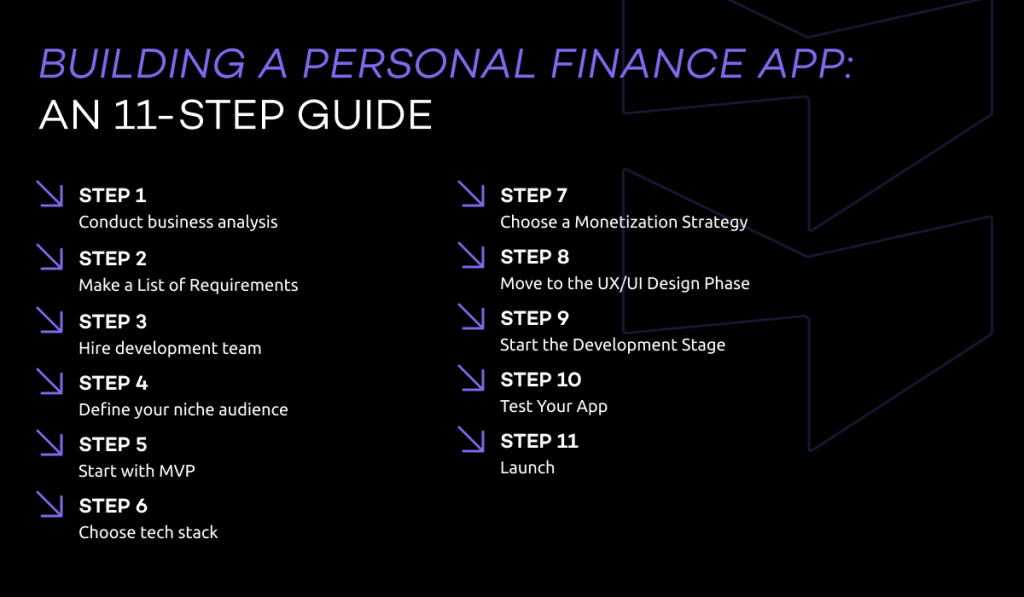

How to Build a Personal Finance App in 11 Steps?

Step 1. Conduct in-depth business analysis

Business analysis involves studying and evaluating a company’s processes to determine the requirements for a new product that can drive growth. The benefits of conducting a business analysis include:

- Identifying ways to increase work efficiency with the new product

- Accurately setting the project’s cost

- Finding opportunities to reduce expenses

- Accelerating the software development process and reducing time to market

The outcome of a thorough business analysis provides a comprehensive understanding of what needs to be developed, in what form, the associated costs, and the expected timeline.

Step 2: Make a List of Requirements for Creating a Financial App

After conducting a business analysis, you must list the requirements for your future product. Describe in detail how you want your fintech app to look and function. Make a list of requirements for functionality, design, size, number of features, and more.

A detailed list of requirements will make it easier and more transparent for your development team to build the financial app. Clearly defined requirements will also help you turn your project into reality faster and with better quality.

Also read: How To Write The Design Specification? [Quick Guide]

Step 3. Hire a personal financial app development team

Collaborating with an experienced team offers a mature fintech app development process and a highly committed team to complete all critical tasks on time.

At Rewisoft, we provide our customers with the best technologies, tools, and practices to bring their ideas to life. From developing a unique value proposition to supporting development through final deployment and post-release support, we are here to help.

Discover how to master fintech software development outsourcing the right way!

Step 4. Define your niche audience

Begin by deeply understanding your target audience, their pain points, and potential issues. This crucial step will allow you to craft your product’s best solutions, identify the feature set, and build an effective marketing plan.

Step 5. Start with MVP financial app development

A minimum viable product (MVP) is a strategy businesses use to validate their ideas and test product demand with minimal investment. In a highly competitive market, starting small with your financial app is crucial. By focusing on basic functionality and a limited budget, you can determine if your personal finance app idea is viable.

Building an MVP helps you to:

- Gather feedback from your target audience

- Test your product on real users

- Prioritize features for future development stages

- Increase brand awareness

- Achieve your first return on investment (ROI) if your idea proves successful

Step 6. Choose tech stack for mobile app development

Once you have an idea of a personal finance app’s features and understand how to build a personal fintech app, you can start choosing the tools and technologies you’ll need to bring this solution to life.

The Rewisoft team offers to use the following tech stack to develop finance products:

– Web development technologies

– Mobile development technologies

Step 7. Choose a Monetization Strategy for Your Personal Financial App

Understanding how to start a fintech app involves thinking about a monetization strategy. The most common strategies to monetize personal fintech app include:

- Freemium Strategy: Offer a basic set of features for free, with more сutting-edge features available for purchase.

- Advertising and In-App Purchases: Targeted ads can provide users with financial products from partners, such as insurance, deposits, or loans. These ads can be based on AI recommendations analyzing users’ spending habits. In-app purchases will require payment gateway integration.

- Paid App: Charge users a one-time fee for full access to all app features.

- Subscriptions: Implement a monthly fee for users to access all of the app’s features

Step 8: Move to the UX/UI Design Phase

Building a financual app involves creating a visually appealing interface. To develop an interactive and user-friendly UX/UI, focus on creating an intuitive user flow and consider seamless screen transitions.

Efficient UX/UI means:

- User-friendliness to simplify user interaction.

- Minimal extra steps in navigation

- Onboarding with helpful tips to teach users how to use your features, enhancing user experience and engagement from the first screen

- Staying updated with UX/UI trends to understand and adopt the most preferred styles and preferences of users

Step 9: Start the Personal Finance App Development Process

The development stage requires qualified specialists to correctly implement all the finance app features. Once the scope of work is approved, developers begin implementing the features step by step based on the chosen tech stack.

The financial app development stage is divided into two essential steps: Front-End Development and Back-End Development.

At Rewisoft, we typically assign at least two experienced front-end and back-end developers to this stage to ensure quality and efficiency.

Step 10. Test your personal finance app

Employ manual and automated testing to check functional and non-functional parts of your fintech app. Manual testing, for instance, allows QA to discover bugs during the earliest stages of the software development cycle. In contrast, automated testing provides immediate product feedback and increases test coverage. This comprehensive approach should instill confidence in the testing process.

Essential types of testing you need to apply:

- Security testing

- Data integrity

- Usability testing

- Functional testing

- Performance testing

Step 11: Launch

Once everything is thoroughly tested, it’s time to launch your fintech app in production environments. But remember, the journey doesn’t end here. Your ongoing support to resolve product inconsistencies, fix bugs, and deliver updates is crucial in maintaining the app’s performance and user satisfaction.

Useful tip: Promoting mobile apps is the most effective through social media, SEO-optimized content, paid ads, and more. To avoid publishing issues, ensure your product complies with the guidelines of the Apple Store or Google Play.

We’ll reply within 8 working hours (CET)

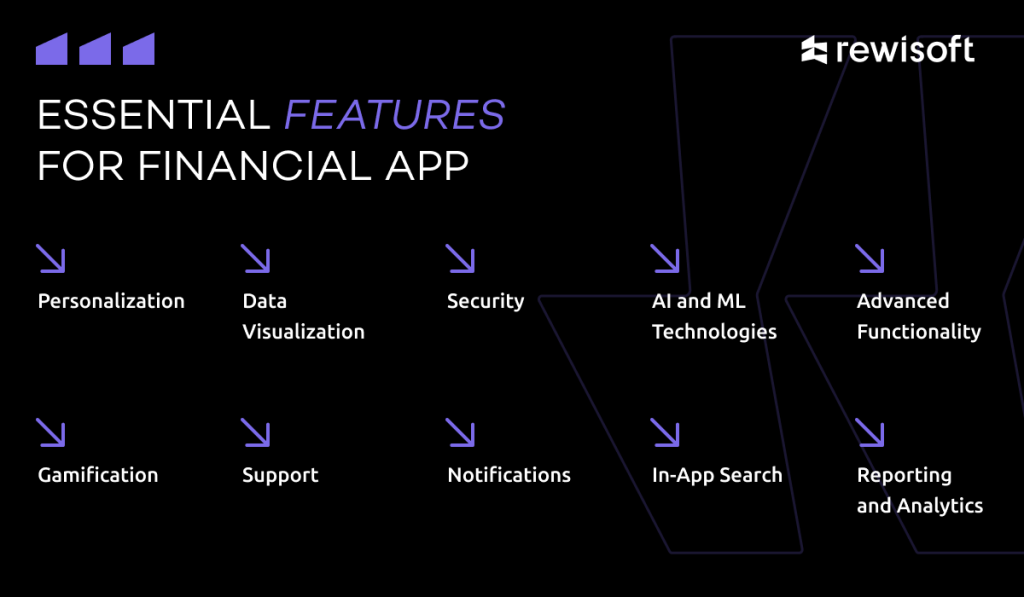

Essential Features for Your Finance App in 2024

With each passing year, financial apps are packed with more advanced features. We’ve compiled the essential requirements and beyond to help you stay ahead in the fintech software market.

Personalization

What is a core component of today’s positive customer experience? You guessed it — personalization. Effective personalization leads to higher user engagement and retention. Offering various customization features to meet specific customer needs is critical. Adding helpful chatbots or advanced analytics tools can make your fintech app more convenient and meaningful, enabling users to solve unique real-life problems.

Data Visualization

Data visualization makes financial client data easy to read and understand. In the financial industry, complex procedures and details can easily confuse users. Develop customized dashboards that display data with interactive infographics and charts to maintain simplicity and clarity.

Security

Maintaining high-level security and compliance with financial institutions’ standards is crucial when handling sensitive customer data. Your app will directly access users’ financial accounts, so robust security measures are essential.

Key security practices include:

- Incorporating biometrics and two-factor authentication (2FA) to verify logins and authorize users.

- Complying with data protection standards such as GDPR and PCI DSS.

- Ensuring your app has ISO 27001 certification (information security management system according to international standards).

- Adhering to your country’s regulations, such as anti-money laundering (AML), Securities and Exchange Commission (SEC) guidelines, the Electronic Fund Transfer Act (EFTA), electronic identification and trust services (eIDAS), and the FinTech Action Plan (FAP).

- Encrypting sensitive data to prevent fraud.

- Conducting regular security audits.

AI and ML Technologies

Artificial intelligence and machine learning technologies enable you to offer must-have app features like AI-based chatbots, intelligent expense categorization, and advanced analytics. AI and ML can also personalize the user experience with unique features, automatic updates, and real-time data analysis.

Advanced Functionality

The more advanced analytics tools your app provides, the better you’ll meet your users’ needs. Features like financial forecasts and budgeting hints help users manage their finances effectively. Additionally, your app can handle complex financial procedures, offering detailed analytical reports and smart savings tips.

Gamification

Gamification keeps users engaged with your fintech app and motivates them to achieve their financial goals faster. Incorporate game elements like scoring systems, rewards, and achievement gifts to enhance the user experience and encourage progress toward financial milestones.

Support

Financial apps often provide 24/7 chatbot support to address client inquiries promptly. A dedicated support team that delivers quick responses fosters customer loyalty and helps expand your app’s user base.

Notifications

Alerts and notifications are vital features that keep users informed and help your business with retention. Types of notifications in fintech apps include:

- Low balance

- Upcoming bills to pay

- Special offers for deals or investments

- Overspending alerts

- Suspicious transactions

In-App Search

In-app search is a must-have feature that helps users easily navigate the app and find any needed information, reducing demand on the support team.

Reporting and Analytics

Reporting and analytics features help visualize financial data, making the app user-friendly. These tools enable customers to track their financial activities, manage their money effectively, and save money. Users can receive daily or annual reports to analyze income and expenses, view forecasts, and more with well-organized data.

Top Tech Requirements to Consider While Building a Finance App

Here are three key tech characteristics to consider when building a finance app:

- Security: Personal finance apps and data centers are prime targets for cybercriminals. Hackers can exploit client accounts to withdraw funds or misuse the accounts. Ensure robust security measures are in place to protect user data and transactions.

- Reliability: The reliability of a financial app is determined by the accuracy of its data processing and storage. The app should be accessible at all times, with proper recovery management in place to minimize the impact of any failures on client data.

- Performance: Financial apps often handle a high volume of transactions in a short period. The app’s response time should be swift to avoid delays in transactional activities, which can impact business operations.

Our Successful Project in the Finance Field

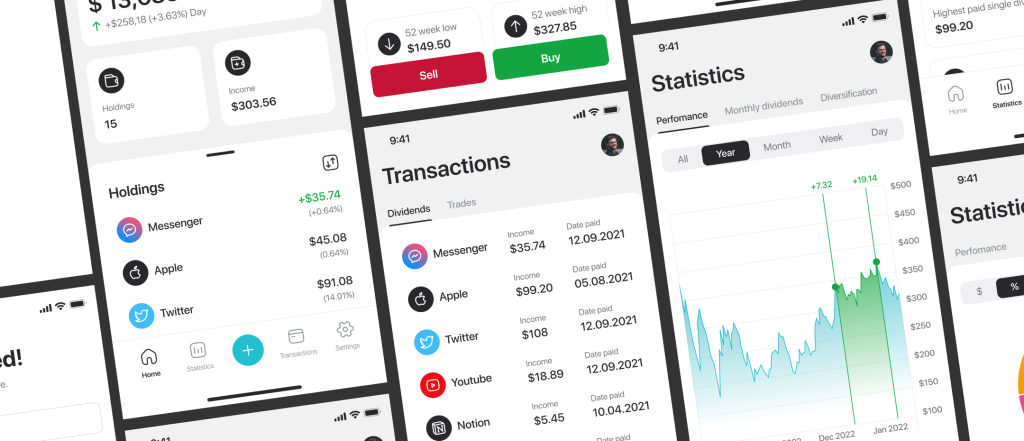

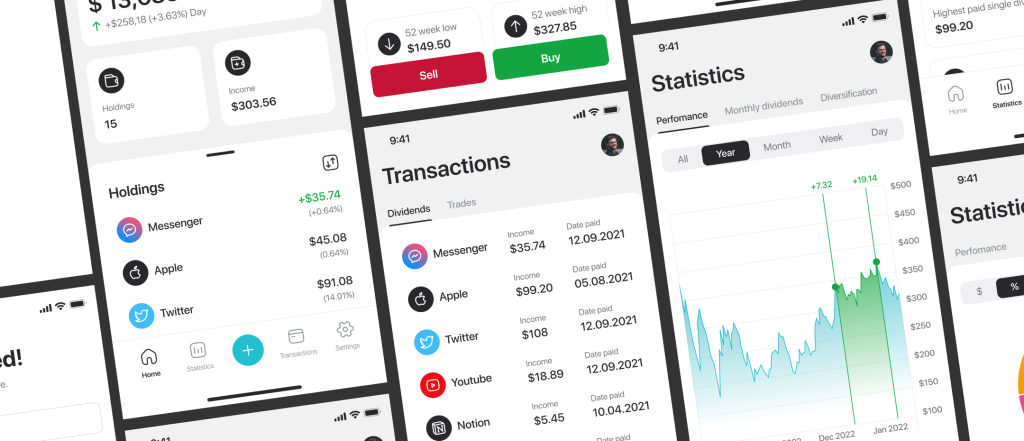

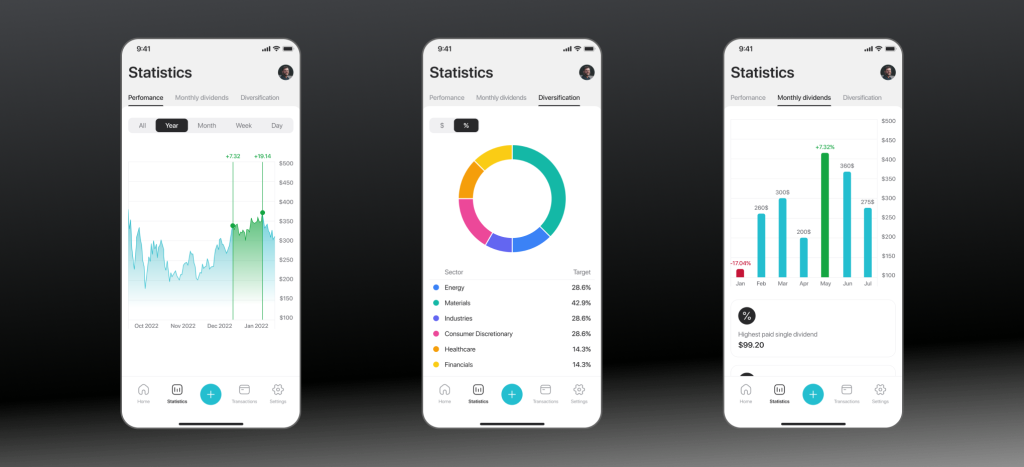

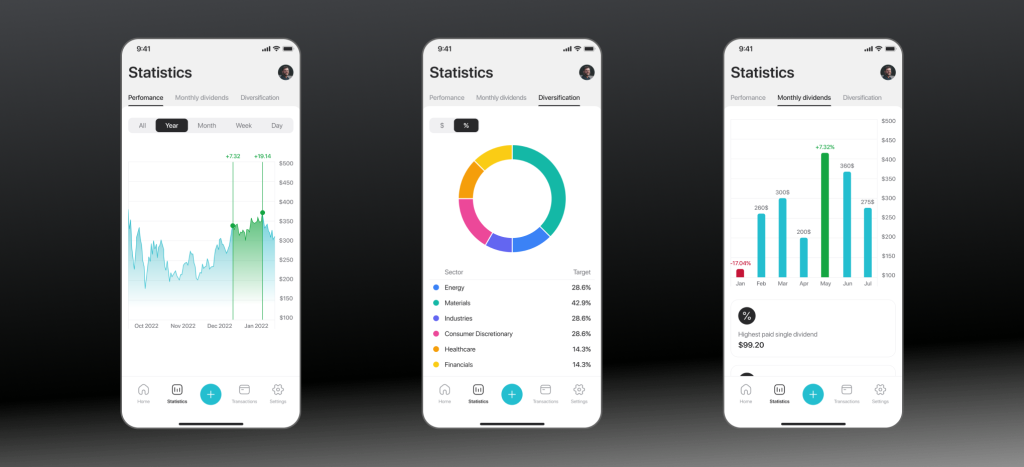

Challenges:

- Develop a solid UI design with advanced features enabling investors to view data on holdings, including current prices, daily changes in value, and overall percentage weight.

- Build a single platform for both novice and experienced investors.

- Create an easy-to-navigate and compelling UX that visualizes investment data with interactive charts.

Solution:

The Rewisoft team successfully developed the following app features:

- Tracking the performance of stocks

- Setting goals for short-term and long-term portfolios

- Interactive diversification charts

- Easy management of stocks

- Customizable stock listings

- Data on returns and percentage weight

Our mobile app development team designed and developed an iOS mobile app that helps beginners and professionals make the most of their investment journey. Using advanced features created by the RewiSoft team, investors can easily access the data they need and track the overall performance of their investment portfolio.

How Much Does It Cost to Build a Personal Finance App?

RewiSoft offers competitive starting prices for custom financial app and web development, starting at $40,000.

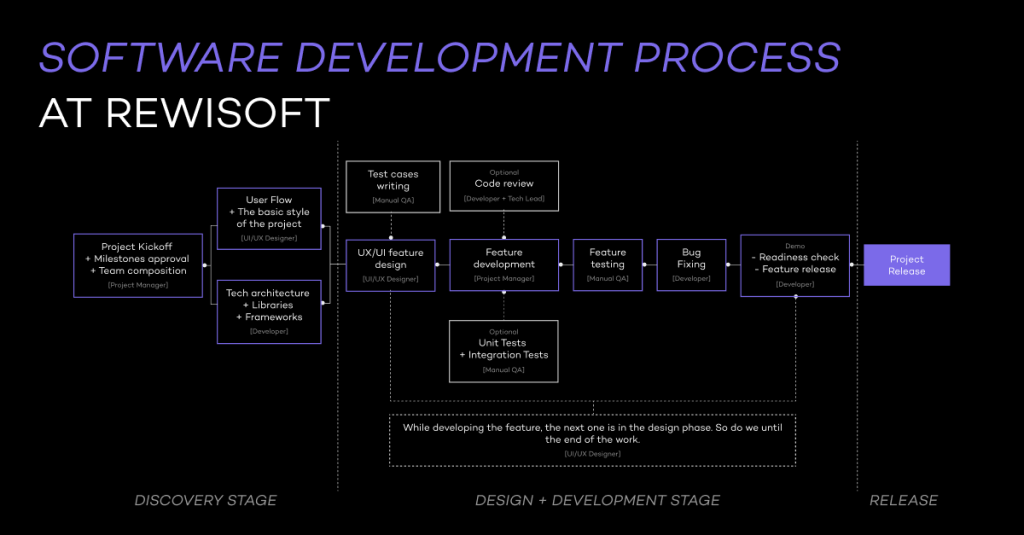

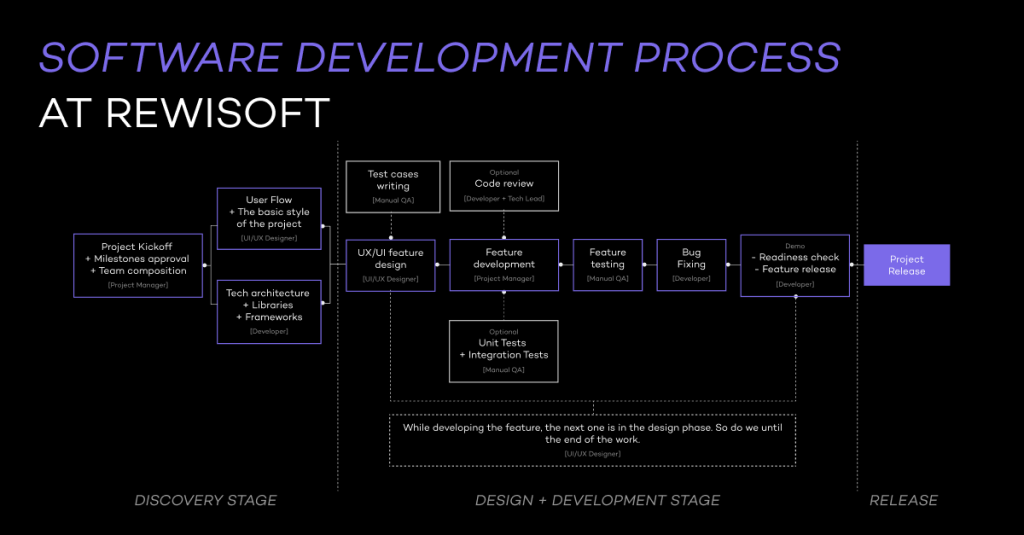

As shown in the image below, the development at RewiSoft is designed to be highly flexible, allowing us to tailor a solution that meets your specific product requirements for your personal finance app.

To determine the final price, consider the other factors that affect cost:

How Long Does It Take to Build a Personal Finance App?

The time of mobile app development depends on several factors, including:

- Project size

- Project complexity

- Number of features

- Functional complexity

- Design complexity

- Team expertise

Building a personal fintech app typically requires 2,000-2,500 hours, equivalent to 6 to 7 months of full-time work. However, the timeline can vary based on the specifics of each project.

Financial Mobile Apps: Top Legal Requirements to Consider

All personal finance apps must meet the standards of at least one regulatory agency. Applications that operate across numerous areas, states, and nations must adhere to unique regulatory standards of regional or national governments and various international organizations. This is critical since failing to comply may result in civil, financial, or even criminal penalties for businesses or persons proven to be responsible.

Among the most well-known regulatory and compliance organizations, whose guidelines are crucial for finance app development, are:

- Australia has four regulatory bodies: the Reserve Bank of Australia (RBA), the Australian Prudential Regulation Authority (APRA), the Australian Securities and Investments Commission (ASIC), and the Australian Competition and Consumer Commission (ACCC).

- Canada has the Bank Act and FINTRAC.

- USA has the Office of Foreign Assets Control (OFAC).

- United Kingdom has the Financial Conduct Authority (FCA).

Personal Finance App Development: Conclusion

Developing a finance app is a complex process. Still, it also presents a significant opportunity for business owners and investors to expand their horizons and drive growth.

RewiSoft can be your trusted partner in creating finance apps and web platforms! With experience in over 130 projects, including 80+ apps and websites, we deliver exceptional tech solutions worldwide.

Learn more about our expertise in fintech software: RewiSoft Fintech Software

We would be thrilled to share our expertise and develop a project that drives business results to incredible success!

Book a demo with your personal project manager