If you’re a budding startup, mid-sized, or an enterprise-level company – choosing to develop fintech software is the right choice for many reasons. Besides facilitating financial transactions, robust fintech software can meet today’s market demands with a focus on personalization and smooth user experience.

However, there may be some hesitation when you choose whether to develop fintech software in-house or outsource it.

In this article, we’ll show you why fintech software development outsourcing is the best choice and how to outsource your fintech projects to avoid project risks, extra costs, and wasted time. Let’s go through all the critical steps of fintech software outsourcing to ensure successful and timely fintech project delivery.

Fintech software development outsourcing: market overview and trends

According to GlobeNewswire, the global fintech market is expected to reach $305 billion by 2025. This forecast shows the fintech trend is not just a short-term trend. The global companies’ adoption of cutting-edge technologies enables businesses to meet high fintech market demand, improve efficiency, simplify financial transactions, and ensure transaction security. Therefore, fintech app development will stay a booming trend for at least several decades.

Modern technologies have replaced traditional methods of banking management. Today’s banking market embraces digital transformation by developing numerous mobile applications and providing quality financial services. Let’s take a look at the latest trends in the digital banking market.

- Online banking. The technology-based banking model enables cashless payments, speeds up transactions, and enhances the user experience.

- White-label fintech solutions. Such solutions allow businesses to create global payment gateway easily.

- Data aggregation. Data aggregators facilitate the exchange of data between financial institutions and their clients.

- Big data. The usage of big data technology allows generating and processing of vast amounts of data for customer retention and service delivery.

- Blockchain. Blockchain technology is used to secure and decentralize financial transactions.

- Robotic Process Automation (RPA). With the help of RPA systems, financial institutions can automate repetitive business operations and increase their productivity and efficiency.

- Voice payments. This trend allows customers to use their voice for banking transactions and interaction with bank managers and quickly get the information they need.

- Microcredit. With microcredit, users can solve individual financial problems by requesting loans online. For example, the HelpPays case is the largest marketplace for short-term peer-to-peer loans that the RewiSoft team has worked on.

Key trends in the FinTech market

Who needs fintech software development outsourcing?

Whether you’re a fintech startup or a solid financial service provider, there are many reasons why companies prefer using the services of remote developers.

Startups

Any fintech startup has budget and resource constraints and a lack of experience. Thus, in the fintech software market, there is a high demand for alternative ways to build digital products. Startups look for ways to decrease project costs and minimize risks of startup failure.

Moreover, according to Clutch, almost 80% of mobile startups fail due to poor planning, the wrong development team, and inefficient use of resources. Thus, choosing the right development team and setting up an efficient and cost-effective fintech app development process is vital.

Mid-sized companies

In the case of mid-sized companies, fintech software outsourcing is an excellent way to delegate software development tasks and assign in-house specialists for other vital tasks. As a rule, mid-sized companies have many projects requiring ongoing attention and support.

Thus, you can hire specific fintech developers or an outsourcing fintech company, freeing your team from unnecessary workload. Plus, you can outsource these tasks at any project stage while avoiding recruitment costs and team member onboarding.

Enterprise-level companies

Enterprise-level companies often transfer some short-term tasks to remote employees to optimize internal resources and avoid unnecessary overheads.

In addition, as the business grows, there is a need to attract specialists with the required level of specialization in software. In any case, well-established brands cannot hamper delivering quality service and customer value due to reputation damage risks.

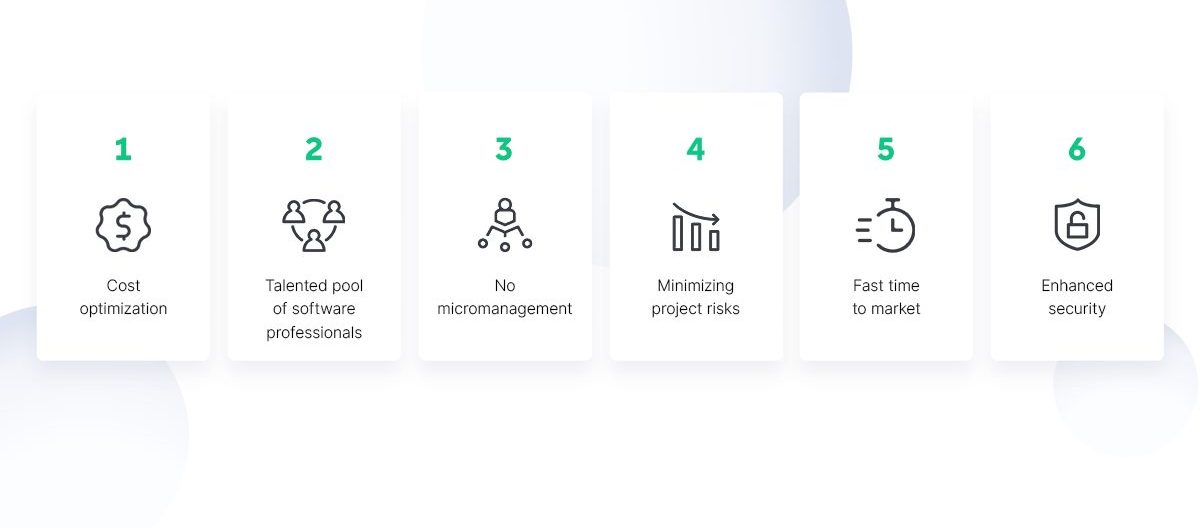

Benefits of fintech software development outsourcing

Let’s discuss the main reasons why outsourcing fintech development is beneficial for your company.

Cost optimization

When you decide to staff your IT department with your in-house development team, building a fintech solution becomes an expensive adventure.

Plus, taking into account the average development rates in the U.S, the rates in Eastern Europe countries are 2-4 times less than in the U.S. To these calculations, we can add additional costs you may need to waste for employee recruitment, onboarding, monthly salary, taxes, and other contract perks.

Your company can avoid such a resource-intensive scenario by opting for fintech development outsourcing. In this way, you can reduce operating costs and recruitment budget and hire tech-savvy professionals who can deliver quality fintech development services quickly and efficiently.

Talented pool of software professionals

Labor shortages, high average developer salaries, and the lack of fintech and regulatory expertise at the local level often push companies to look for developers offshore. Fintech outsourcing allows you access to a global pool of software experts.

You can find the right developers who use the latest technology and have strong engineering skills and industry experience to deliver successful fintech solutions to the market while saving time and costs for talent acquisition.

No micromanagement

Fintech software outsourcing can help you focus on your core business and avoid recruitment and management issues. Your fintech software development can be outsourced to a remote team.

The outsourcing team will handle the tasks of the software development process, such as team onboarding, establishing effective communication, and the like. This will save you time and effort and allow you to micromanage less and focus more on growing your business.

Minimizing project risks

Fintech outsourcing is a good option in terms of risk mitigation. The outsourcing team is higher committed to delivering quality and secure fintech solutions on time than the in-house team.

Thus, when you outsource your project to experienced engineers, you can mitigate many potential risks in fintech software development. Plus, top fintech development outsourcing companies provide ongoing post-release product maintenance. This will help you eliminate most product errors and bugs and ensure a smooth user experience.

Fast time to market

Time to market is the only aspect that sets your company apart from overcoming your potential competitors. If your fintech product development is stretched over time, your competitors can capitalize on this opportunity by launching a fintech solution faster.

So, instead of wasting time and resources on a time-consuming in-house team and management, you can outsource your project to a full-cycle fintech software development company and release a high-quality solution on time.

Enhanced security

Security is the main pillar of successful fintech product development. Since the financial industry operates with sensitive customer data, a fintech development outsourcing company needs to comply with security standards and fintech regulations.

To prevent data breaches, cyber-attacks, and other security flaws, it’s better to hire a professional team. Such a team must implement data security standards (PCI DSS, OWASP) to comply with financial industry standards and create secure software.

Benefits of fintech software outsourcing

3 hiring options when you outsource fintech software development: pros and cons

When looking for the best choice for fintech development outsourcing, there are three options to start building your fintech solution. Let’s address the pros and cons of each option.

Freelance developers

| Pros | Cons | |

| Freelancers |

|

|

When you decide to hire fintech freelancers, you will need a tech professional to handle all recruitment, onboarding, and mentoring issues. Organizing freelance work and tracking any potential problems you might have is unreasonable. Also, this hiring type is risky because building the wrong team can cause your startup to fail.

In-house team

| Pros | Cons | |

| In-house team |

|

|

To assemble your in-house team of fintech developers and tech specialists, you will need hiring expertise and more responsibility for legal issues, risk, and work management. Despite the benefits of the in-house team, the recruitment process is time- and resource-intensive. You’ll need to allocate time to manage the team, pay a monthly fee, and allocate expenses for office rent, software, or hardware required for internal teams.

Fintech development outsourcing company

| Pros | Cons | |

| Fintech outsourcing development company |

|

|

The fintech software outsourcing option remains the best. In addition to a high level of industry experience, you get risk and project management, transparent workflows, tech-savviness, and less micromanaging. Also, if you choose the right outsourcing fintech development company, you will get experts working on small, medium, or enterprise-level projects.

Ready to develop your fintech project? Learn how to convert your idea into a viable fintech solution with our dedicated software development team!

Fintech software development outsourcing at RewiSoft

We have extensive experience developing successful fintech solutions with various application concepts and technology stacks. Take a look at some of our successfully released projects below.

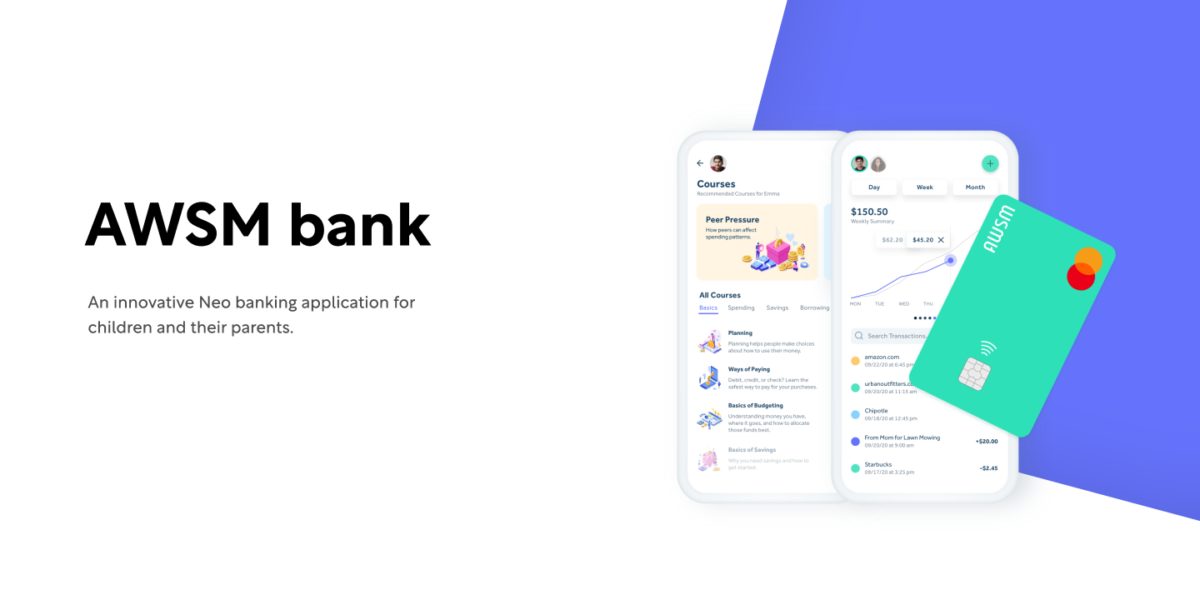

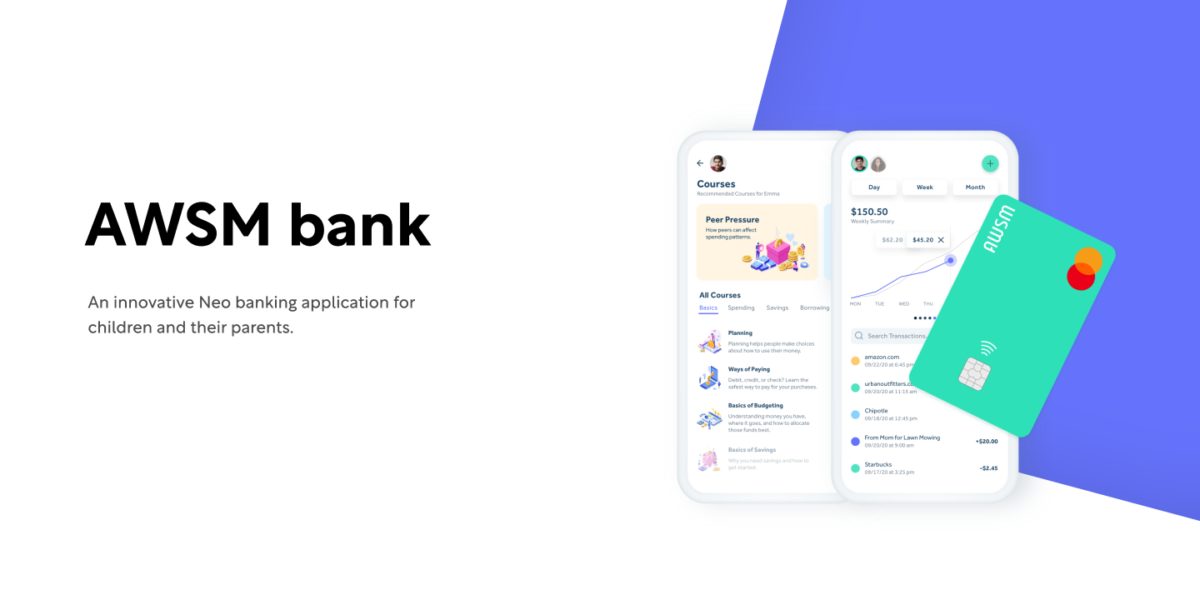

- Banking Apps / NeoBank Apps. AWSM bank is a Neobank app for kids designed to help parents control money transactions remotely. The peculiarity of this platform is the built-in functionality for teaching children financial literacy.

AWSM bank

- Loan Apps. HelpPays is the largest marketplace for short-term peer-to-peer loans. This online P2P marketplace compares favorably with similar applications with advanced and high-performance functionality. Users can borrow money without bank fees or join the lender community and earn extra income by lending money.

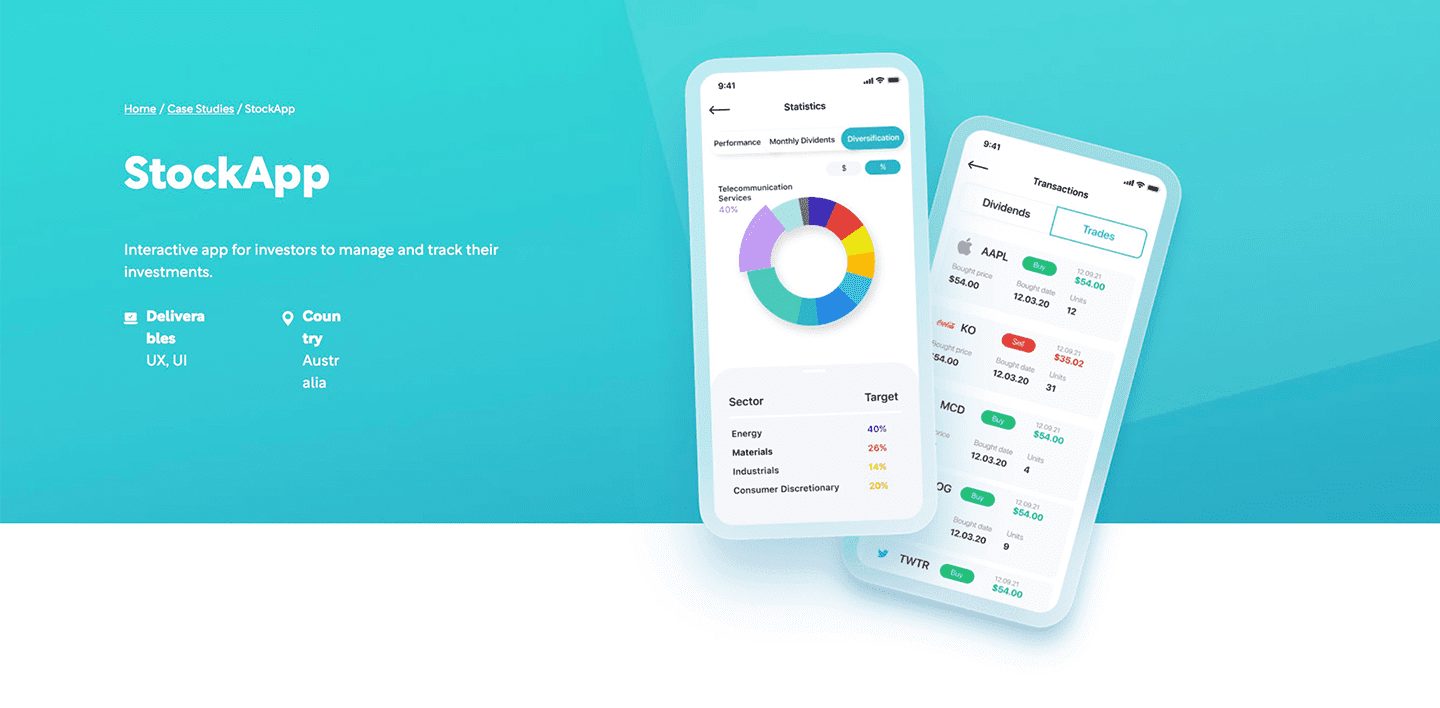

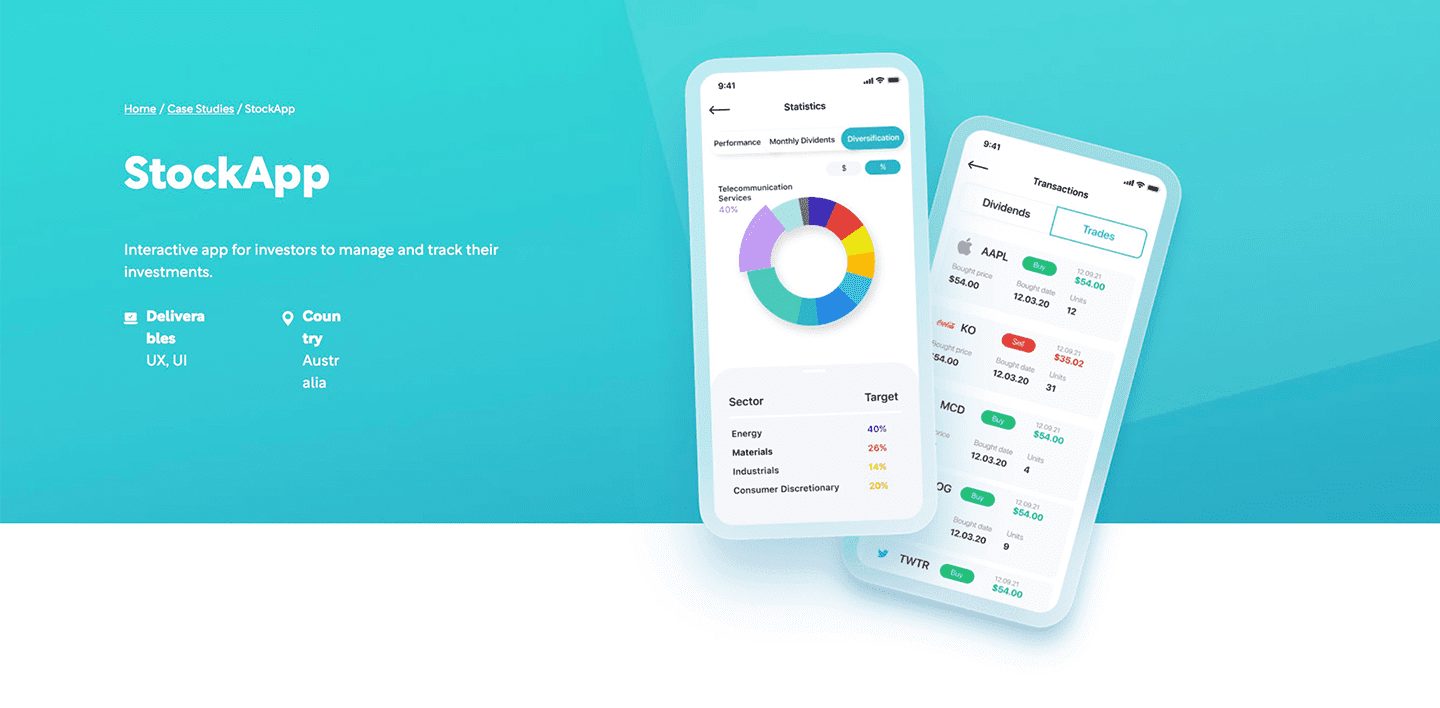

- Personal Finance Apps. StockApp is a personal finance app that allows investors to manage and track their investments and get more out of their investment journey.

StockApp

- Cryptocurrency Apps. FXF is a cryptocurrency app that facilitates trading operations both for professionals and beginners. Both desktop and mobile versions allow users to simultaneously observe oscillations in four markets, view explicit datasets, and monitor fluctuations in leading exchanges with a single wallet.

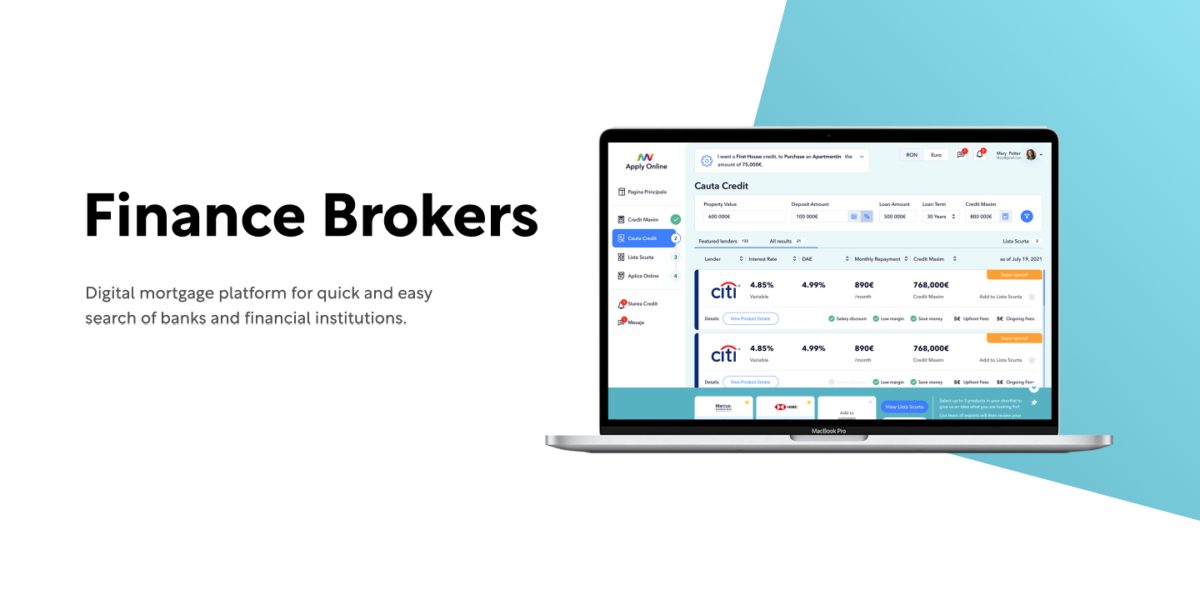

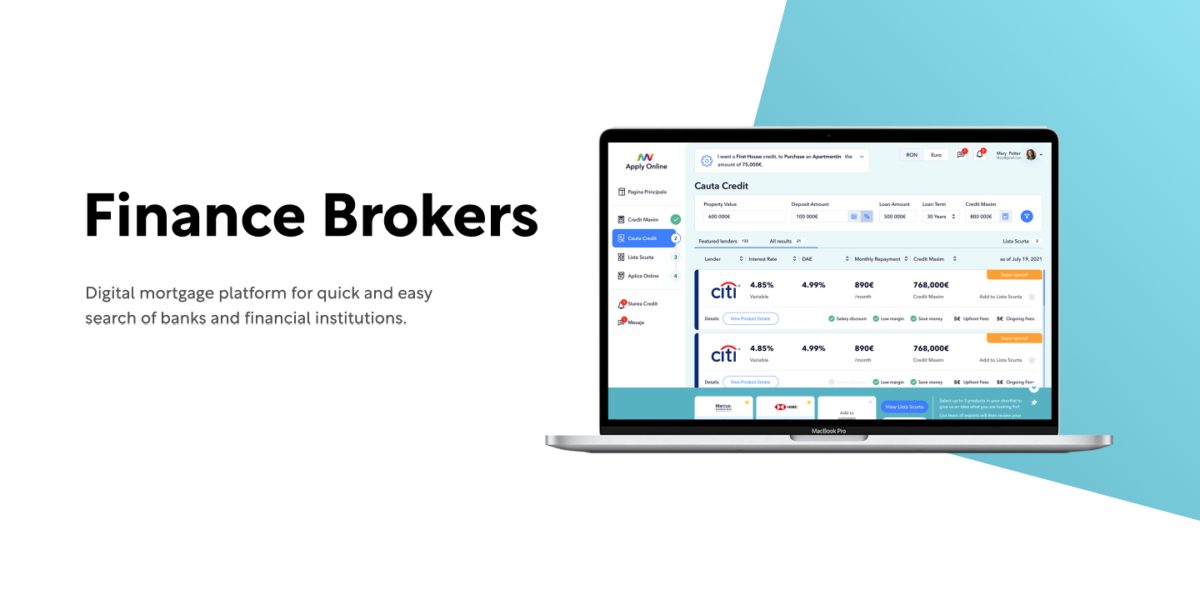

- Mortgage Apps. Finance Brokers is a mortgage platform that helps users find banks and financial institutions and get mortgages at the best price/exchange rate.

Finance Brokers

The RewiSoft team comprises experienced product developers, UI/UX designers, project managers, QA engineers, and business analysts. We help our clients to turn any fintech idea into a compatible product and solve the most complex client problems.

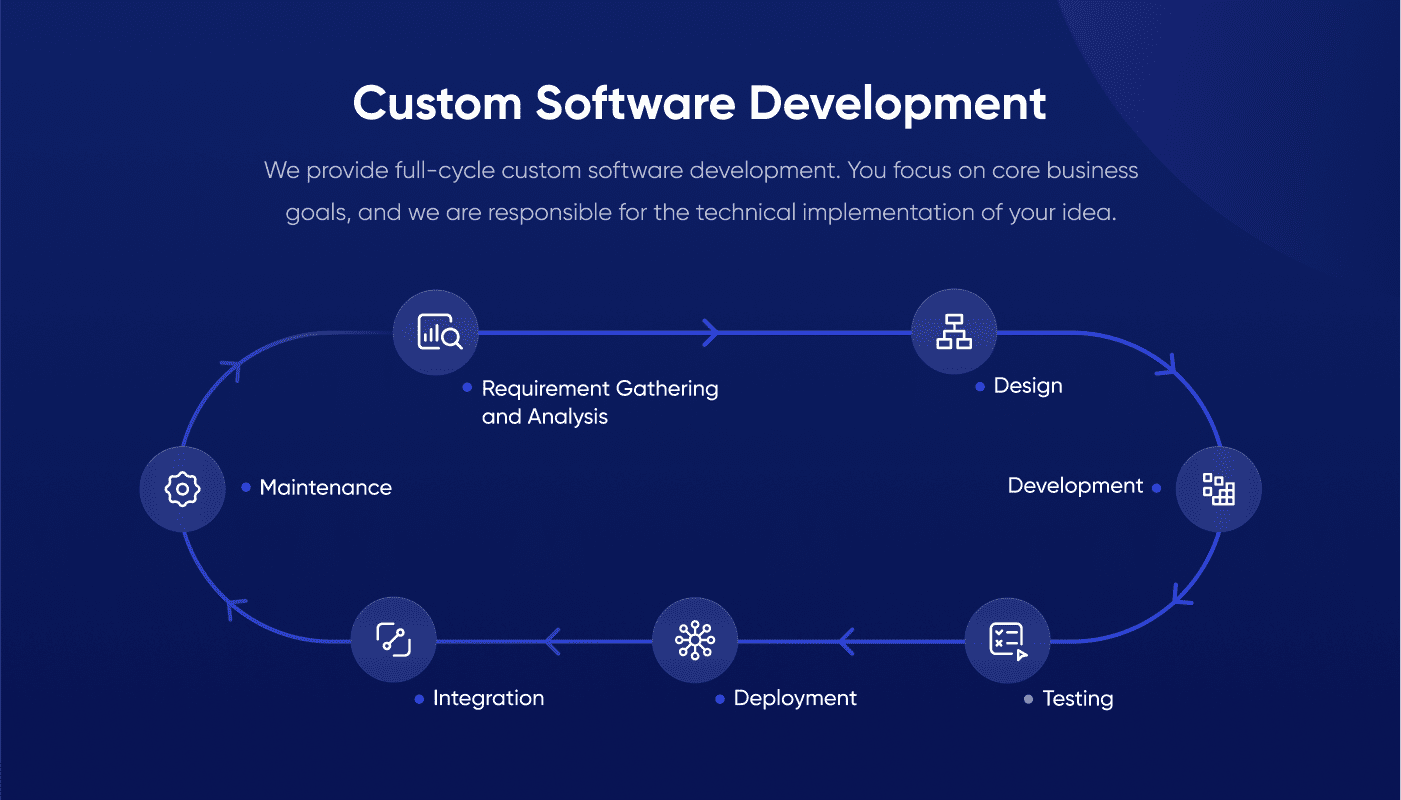

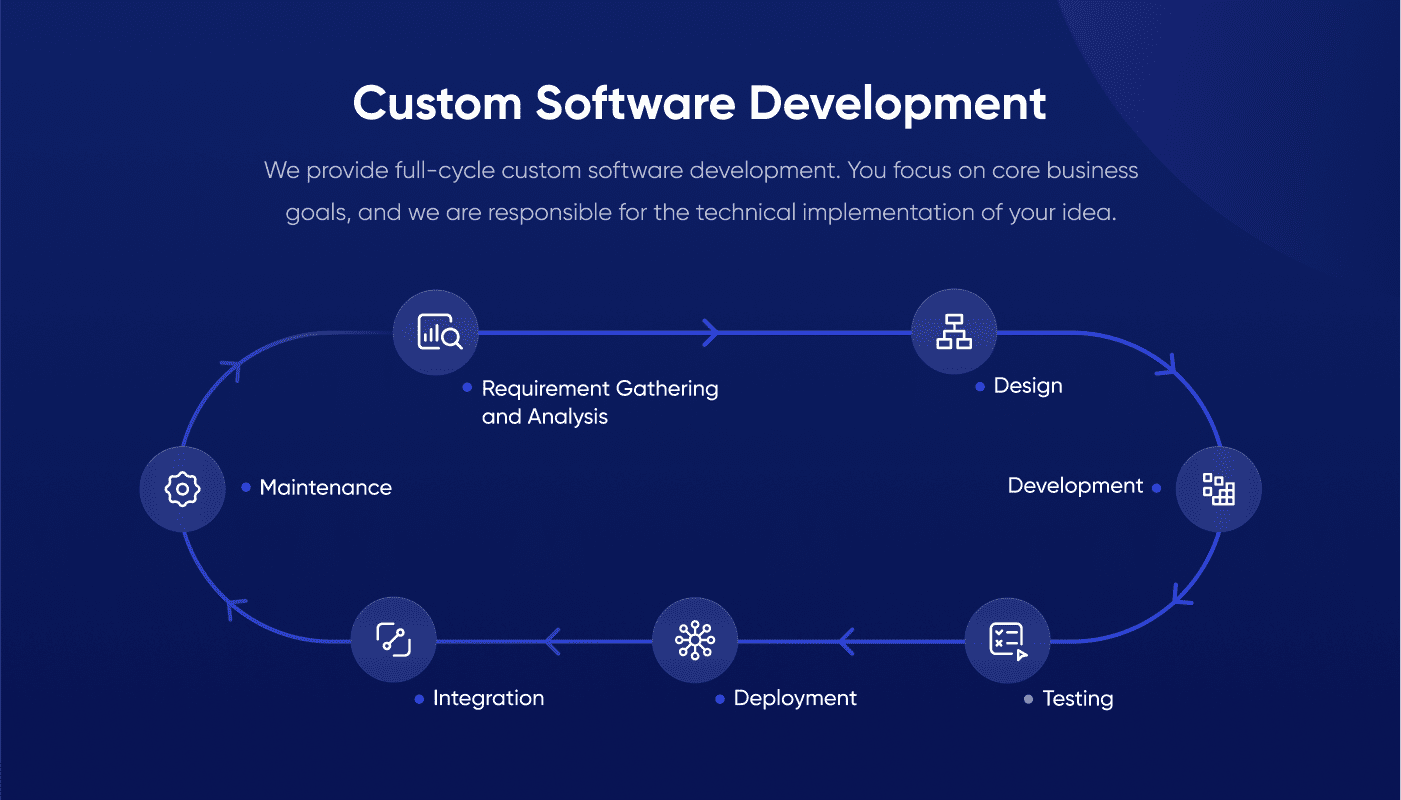

Custom software development

Our process starts with in-depth product discovery, where our BAs conduct market research and finalize technical requirements.

After that, we move on to wireframing and prototyping to design workable prototypes and wireframes to provide a great user experience. During the fintech product design, we ensure the design concept and overall app flow meet our client’s expectations.

The RewiSoft development team embraces digital transformation and chooses the tech stack that meets functional requirements and fintech regulatory standards.

We also integrate QA and testing cycles during product features’ implementation to ensure the fintech solution is bug-free.

During the deployment, we provide a smooth and error-free app launch and supply regular updates during the post-release stage to improve the product’s functionality and user experience.

Are you planning to develop a fintech project? Get in touch with the RewiSoft team.

How to choose the right destination for fintech software development outsourcing?

Choosing the right destination to outsource fintech development is difficult for newcomers to the fintech industry. As a fintech project’s stakes are high, you’ll need to find a trustworthy outsourcing partner to build your product according to quality standards and business needs.

There are three types of location-based outsourcing models: onshore, nearshore, and offshore.

| Pros | Cons | |

| Onshore (partnering with a software development agency within your location) |

|

|

| Nearshore (cooperation with a software development agency in your neighboring country) |

|

|

| Offshore (cooperation with a software development agency in a non-neighboring country) |

|

|

Offshore outsourcing in Eastern Europe is a popular choice for Western and European clients due to the deep tech talent pool, technology diversity, reasonable quality-to-cost ratio, etc.

Our recent blog post on Eastern Europe outsourcing reveals why companies of all sizes outsource in Eastern Europe, what criteria to look for when choosing an outsourcing partner, and which countries are best for outsourcing.

3 fintech software development outsourcing cooperation types

When you choose a trusted fintech development outsourcing company, you should be able to select the cooperation model that works best for you. Let’s review the most popular ones by clarifying their pros and cons.

Dedicated team

In this model, the client pays monthly salaries to hired professionals throughout the project for a specific time. You can use this model to maximize the efficiency of your in-house development team by outsourcing a few IT professionals with the required expertise. The dedicated team type is best suited for long-term projects that require specialized domain knowledge.

| Dedicated team | |

| Pros | Cons |

|

|

Fixed price

The client and the vendor agree on the scope of work, the timeframe, and the budget before development starts. This model works best for small projects.

| Fixed price | |

| Pros | Cons |

|

|

Time and resources

This model is suitable for small or medium-sized projects with no predefined requirements or projects requiring limited resources. In other words, the client only pays for the time the remote team spends on development.

| Time and material | |

| Pros | Cons |

|

|

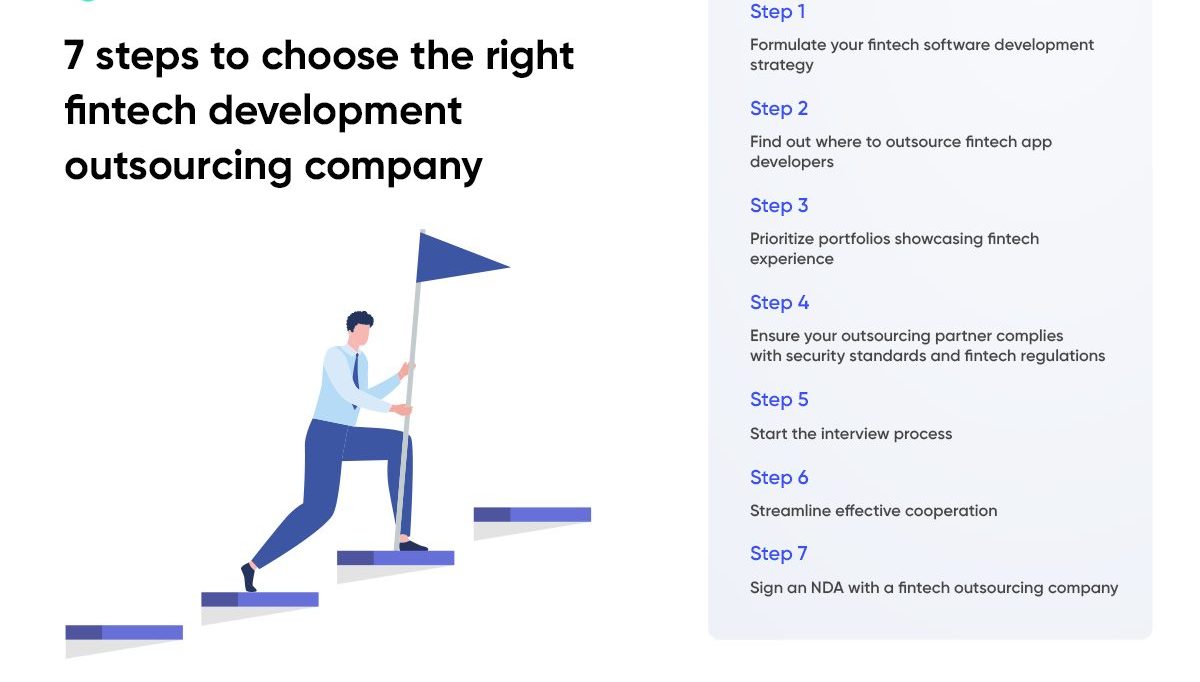

7 steps to choose the right fintech software development outsourcing company

7 steps to choose the right fintech development outsourcing company

After learning the specifics of fintech software outsourcing, let’s outline the step-by-step procedure for choosing the right IT services vendor.

Step 1. Formulate your fintech software development strategy

Hiring a reputable fintech development outsourcing company will help you with product discovery and additional market research. However, you should have your vision for a fintech product.

On the one hand, this will make it easier for a service provider to match your fintech solution expectations. In this way, your remote team will help you map out a clear product development roadmap, create the right product and user requirements, and choose the best tech stack.

On the other hand, it will help you narrow your search for fintech outsourcing providers that meet your project needs and collaboration preferences.

Step 2. Find out where to outsource fintech app developers

Once you have decided on the hiring option that best suits your project needs and capabilities, there are several ways to find where to outsource a fintech project.

You can start googling the company or follow the recommendations of your business partners. Either way, we would like to share a list of special websites where you can find your remote team.

- Clutch, GoodFirms are B2B directories for searching fintech outsourcing development companies. These options are trusted platforms where you can filter your search and find all up-to-date information about companies, check customers’ testimonials, view profiles, and quality-to-cost ratio.

- LinkedIn, Glassdoor are platforms for hiring individual IT specialists.

- Upwork, TopTal, Guru are freelance websites that link businesses to their recruitment needs

RewiSoft has a strong background in developing various fintech products. Our talented development team can transform any idea into a secure and efficient fintech application.

Step 3. Prioritize portfolios showcasing fintech experience

Another guarantee of developing a high-quality fintech solution is choosing an outsourced development team with long-term fintech experience. By checking the company’s previous projects, you will ensure the track record of success and inherent capabilities to deliver quality products.

An experienced development team should know all software development process intricacies, be competent in all required technologies, and be prepared to tackle challenges and meet deadlines.

Step 4. Ensure your outsourcing partner complies with security standards and fintech regulations

We already mentioned that the critical requirement for fintech development outsourcing is compliance with security standards and fintech regulations. The remote professional team should be aware of rules regarding fintech application development in your area and protect customer data.

To prevent data breaches, cyber-attacks, and other security flaws, check ISO 27001 certification (information security management system according to international standards). Also, the team should implement PCI DSS (Payment Card Industry Data Security Standard) and OWASP(Open Web Application Security Project) to comply with financial industry standards and create secure software.

Step 5. Start the interview process

When selecting a pool of potential candidates, there are several aspects to remember before you make a final decision.

- Find out if you share the same values and corporate culture

- Ensure the communication policy fits your expectations

- Evaluate technical competencies of the team, applied development practices, quality standards, and qualifications

- Check out the project management maturity and transparency to understand how the team makes decisions, tackles challenges, and resolves risks

- Interview candidates asking if they have enough experience in the financial industry

Read our previous blog post for practical tips on how to find app developers and interview them in more depth.

Step 6. Streamline effective cooperation

Invest your time into discussing the team’s communication and management tools, how project results will be delivered, and how the team will ascertain the app’s quality before final deployment. Establishing business communication guidelines right from the start will ensure transparency during the development process.

Step 7. Sign an NDA with a fintech outsourcing company

Signing a non-disclosure agreement (NDA) is a valuable step toward the efficient and reliable development of fintech solutions. The purpose of an NDA is to protect your intellectual property rights and document the legal aspects of product development in terms of:

- A detailed description of the services provided

- Project time and cost

- Termination details

- Agreement duration

- Confidentiality and disclosure consequences

- Acceptance criteria

How to eliminate risks when outsourcing fintech software development?

The following tips will help you eliminate risks and get the most out of outsourcing fintech development.

Ensure data confidentiality

You risk losing sensitive data when you outsource your fintech project. To ensure that you cooperate with a reputable software development agency, you must sign a non-disclosure agreement to protect your intellectual property rights. NDA includes outsourcing services descriptions, agreement duration, contact termination details, project time, and costs.

It’s also better if you outsource your projects to companies located in countries with a mature business environment and robust intellectual property protection. Some examples of countries meeting these criteria are Ukraine, Poland, and the Czech Republic.

Discuss the scope of work, deadlines, and budget

If you’ve decided to deal with an offshore fintech software outsourcing company, keep in mind to agree on the scope of work, deadlines, and budget. Discussing and creating a delivery plan containing a specific budget and timeframes is crucial for a successful fintech outsourcing experience.

Establish transparent communication

Establishing workflow patterns and transparent communication will help you avoid project bottlenecks on time, check the team’s progress regularly, and stay on the same page with your development partner. Regarding workflow, it’s also better to focus on setting available communication channels, reporting mechanisms, and timing.

Validate the company’s experience

To ensure high fintech app quality, validate your potential partner thoroughly. Check references and clients’ feedback on dedicated platforms like Clutch; examine the company’s website and fintech development background to see how the team tackles development challenges and have deep knowledge of the development process.

In this way, you will understand if your remote team has experience working with a fintech project of any size and providing quality solutions.

How much does it cost to outsource fintech software development?

Starting prices for custom fintech development at RewiSoft:

- Fintech Mobile App Development: Starting at $30,000

- Fintech Web Platform Development: Starting at $30,000

Factors that can affect the final project cost:

- Business model

- Features package

- Expected time to market

- Development approach

- Team location

- Team size

- Team expertise

- Hiring model

Either way, the RewiSoft team can calculate the required budget and project timeline based on your product specifications and business needs. Get an estimate right now!

Fintech Software Development Outsourcing: Conclusion

Fintech development outsourcing delivers the best possible results for fintech companies looking to provide a profitable and competitive solution to the market.

Startups, small-to-medium businesses, and enterprises benefit differently from fintech projects outsourcing. Some streamline internal processes, while others reduce time to market, save on costs, expand their customer base, or maintain a high level of fintech solution quality.

All in all, the main incentive is to remain competitive by meeting today’s customer expectations and providing a quality experience.

Share with us what your project lacks, and we’ll contact you as soon as possible to help you achieve your goals twice as fast!