Content

In our new article, we will tell you how to make a payday loan website. The popularity of such sites is growing, so many microfinance organizations are interested in making quality websites for their services.

We will look at the main reasons for creating a payday loan website, the features that should be present on such a website, the development cost, and many other aspects. Also, based on our experience, we will share a step-by-step guide on how to make a payday loan website.

How Do Payday Loan Websites Work?

A payday loan is a term for a small, short-term, unsecured loan issued by microfinance institutions. The issuance of such loans depends on the data on the previous salaries of clients and their employment.

A payday loan website is a website using which people can quickly get a short-term loan. Such sites have functionality that allows people to quickly take out a payday loan and also repay it later. Such sites have all the necessary information about clients and their credit history.

Here is the scheme by which payday loans work:

Clients register on a payday loan website by filling out a registration form.

The only documents required are identification, a recent pay stub, and a bank account number.

Loan amounts range from $50 to $1,000, depending on the law in the location where clients live. People who are authorized receive cash at the moment or have it sent into their bank account within one or two days.

Payment in full is required on the borrower’s next payday, which is usually two weeks.

Borrowers can either post-date a personal check to correspond with their next salary or enable the lender to deduct the funds automatically from their account.

Every $100 borrowed from a payday lender typically has an interest rate of $15 to $20. Payday loans have an annual percentage rate (APR) ranging from 391% to more than 521%, the same as credit cards, mortgages, auto loans, and so on.

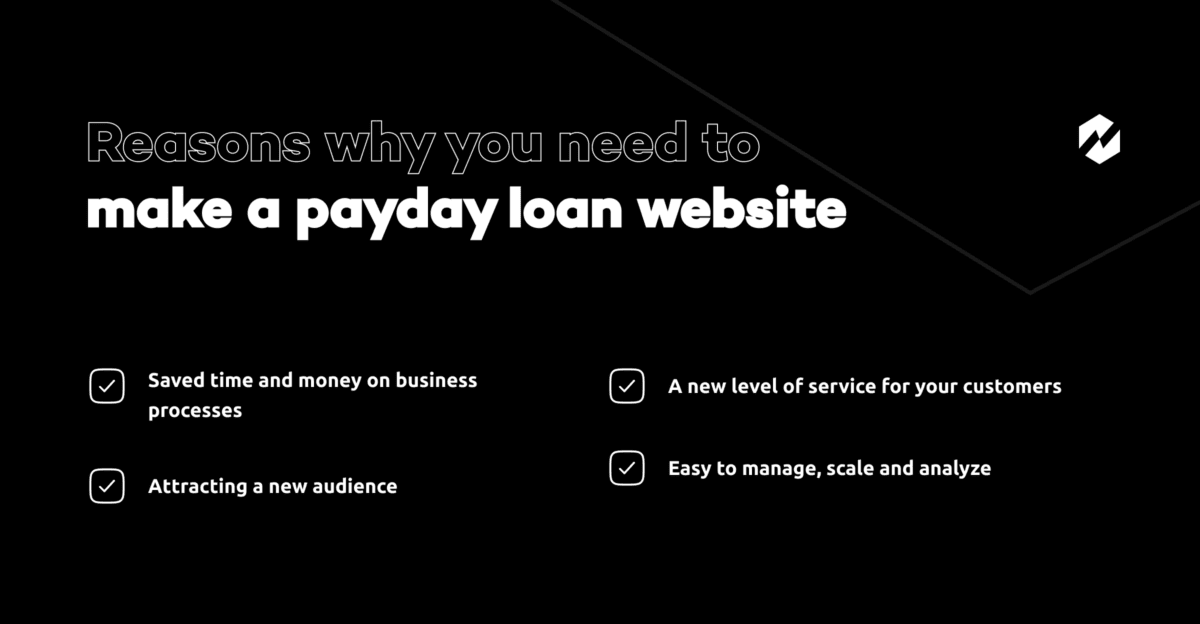

Reasons Why You Need to Make a Payday Loan Website

If you are still wondering if your business needs a payday loan website, we will try to convince you that you need it. We have prepared some of the main reasons you should start creating a payday loan website.

Saved time and money on business processes

Firstly, such a website will help automate many processes of your business. Therefore, it will save you time and money. You no longer need to spend time on, for example, manually filling out all client forms, conducting money transactions, verifying the authenticity of client documents, etc. All these processes will be automated on your website. Also, you will not need to hire a large number of employees. A website can handle all the influx of work.

Attracting a new audience

The modern world is very digitized. People prefer to use online services. Just think: people buy online, people study online, people book online, etc. And if there is an opportunity to take a payday loan online, then people will definitely not refuse it. Therefore, creating a payday loan website will help you take your business to the next level. Such a site will help you open your service to more people and attract a diverse audience.

A new level of service for your customers

By creating a payday loan website, you will automatically make a new level of service for your customers. This will show that you care about your customers. After all, now people will not spend a lot of time using your services. They can get a payday loan in just a few minutes. And it’s all thanks to your website.

Easy to manage, scale, and analyze

The website will give you the ability to manage, scale and analyze your business efficiently. In just a few minutes, you can analyze the number of users of your site, the number of applications left for the last period, the amount of time a user spent on the site, and much more. Also, it will be easier for you to develop and improve your business based on statistics and analysis. Moreover, it will be convenient for you to monitor, control, and manage all operations that will pass through your site.

Let’s Get Started!

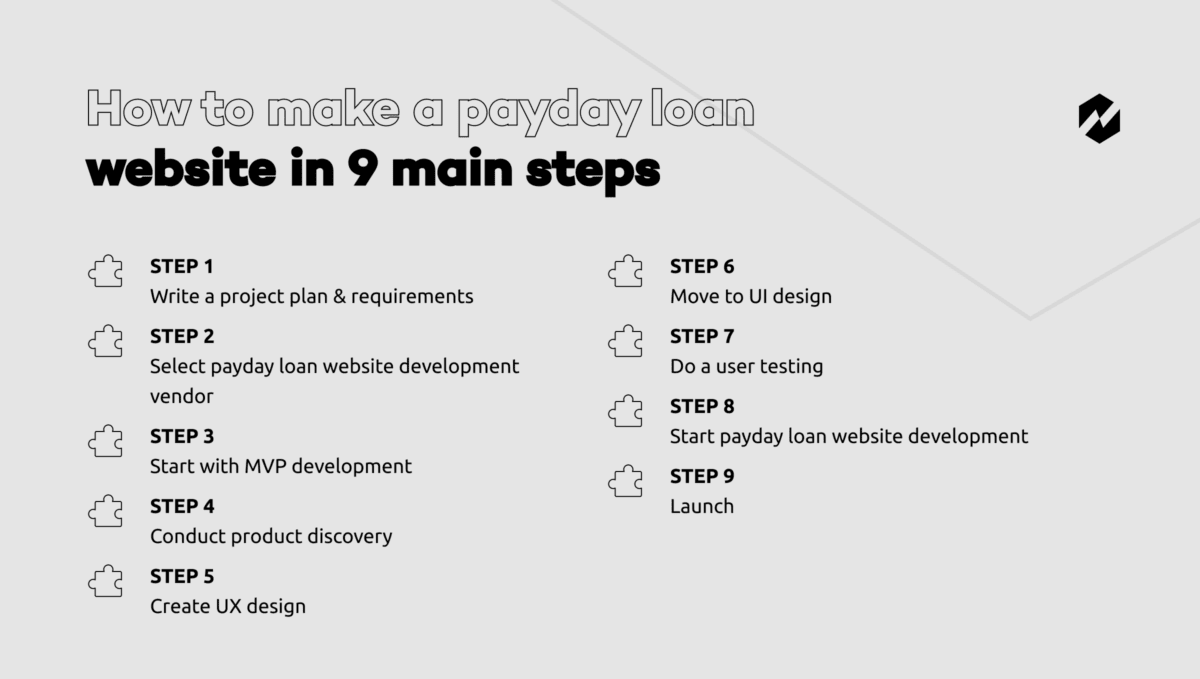

How to Make a Payday Loan Website in 9 Main Steps

How to make a payday loan website that will win the users’ hearts? We have prepared a step-by-step guide that will help you understand the main processes involved in creating a payday loan website. Let’s look at each of them individually:

Step 1. Write a project plan & requirements

The first thing you need to do is to make a plan of your actions. Describe all the steps by doing which, as a result, you get the finished product. The more detailed you describe everything, the easier it will be for your design and development team, for example, to understand what exactly you want to achieve in the end.

You should also write a requirements document. Requirements (specifications) are crucial in the product development process, and they have been discovered to play several roles, including:

- Design and development team guidance.

- Identify the intercommunication requirements.

- Checklist, e.g., at meetings or workshops.

- An agreement within the design and development team and as a contract with the customer, e.g., a supplier agreement, to perform the task.

- Trace the probability of propagation of change.

- Product overview.

Usually, the product requirements (specifications) document includes the following things:

- Full project overview.

- Main needs and goals.

- Target audience.

- Functional requirements and desired set of features.

- Aesthetic aspects.

- Non-functional details.

- Recommendations and prohibitions.

- Questions.

If you want to learn how to write such a document, check our article How To Write The Design Specification? [Quick Guide].

Step 2. Select payday loan website development vendor

Next, you should select the design and development team for your project. The success of your product largely depends on the team that will work on it. Therefore, pay due attention to this step. There are several ways to find a good team:

- Social networks. In social networks, you can collect a large amount of information about companies and agencies that create tech products. You can find representatives of such companies and chat, finding out about the team’s experience, the specifics of projects, prices, conditions, etc.

- Rating sites. On rating sites, you can compare teams by their rating, as well as read reviews from past clients. Moreover, on sites like Clutch. co, you can find descriptions of projects the team has worked on before and their results.

- Friends and colleagues. Reach out to your partners or friends. Ask if they can recommend a good design and development team. They may have had a great experience working with a reliable team in the past and can share contacts with you.

- RewiSoft. You can contact us! We are a team of specialists who will gladly take over the entire design and development of creating your payday loan website. If you already have ideas, don’t hesitate to contact us.

Step 3. Start with MVP development

Start building your payday loan website with an MVP to test your product idea. This strategy will help you understand whether the product you offer is valuable for users, whether the functionality suits them, whether they like the product’s look, etc.

MVP is a fast and reliable way to ensure you’re doing the right thing. If you want to learn more about the process of creating an MVP, read our article “How To Create a Minimum Viable Product (MVP)? [Startup Case Studies].”

Step 4. Conduct product discovery

The next step is product discovery. It is a complex business process used to develop new products in global companies. It is a clear statement of what needs to be developed to be interesting and useful to modern customers.

The process consists of smaller sub-processes that are closely related to each other. Product Discovery allows you to reflect the developer’s visionary qualitatively, detail the needs of the target audience, and also answer key questions about the product:

- Is it worth solving the problem?

- Will the suggested solution work?

- Will customers use and enjoy this solution?

If at least one question is negative, then the developers go back to basics. The process consists of detailed work on the product’s properties and long surveys of representatives of the target audience.

All this continues until all 3 answers to the presented questions are positive. That will bring a final product to the market that will benefit clients and generate profits for product owners.

Step 5. Create UX design

After product discovery, you can start UX design. How to make a payday loan website that will be user-friendly and easy to use? Build a great UX design.

Designing for the user’s perspective is the goal of user experience (UX) design. Not only should a product’s aesthetic appeal and use be taken into consideration, but so should the product’s price, portability, and overall value. They’re more challenging to conceptualize and bring to fruition.

UX design encompasses all aspects of the user’s experience, from the design of individual interactions to the overall look and feel of the product. Designing user interfaces is the responsibility of UX designers. They outline the application’s interface structure and functionality, as well as how the various components are linked together. Designing the interface is a big part of their job.

The user will have a positive impression of the interface if it functions well. However, if the navigation is difficult or unintuitive, the user is likely to get disgusted when using the interface. Avoiding the second scenario is the primary goal of a UX designer.

Step 6. Move to UI design

How to make a payday loan website that will be visually attractive for users? Build a great UI design. UI focuses on all the product elements that make it compelling: colors, button styles, graphics, animations, typography, infographics, widgets, behavior, button responses, etc.

The UI designer is responsible for how the user perceives the product from a visual point of view. It takes a UX designer’s scientific findings and conclusions and turns them into a specific art form.

The successful combination of iconography, typography, color, space and texture will help the user easily navigate the finished application.

Step 7. Do a user testing

After the UX/UI design is ready, start testing. At this stage, you will need to check how well users perceive the product and understand how to use it.

During testing, you should receive answers to the following questions:

- Does the user understand how to use the product?

- Is it easy for users to find the desired items/sections of the product?

- Is there anything distracting the user?

- Do users achieve their goals by using the product?

After you receive answers to these questions, correct all mistakes and shortcomings, you can proceed to the next stage.

At RewiSoft, for user testing we use UX Eye Tracker that allows exploring user behavior during interaction with the product. Only 1% of companies use this method.

Step 8. Start payday loan website development

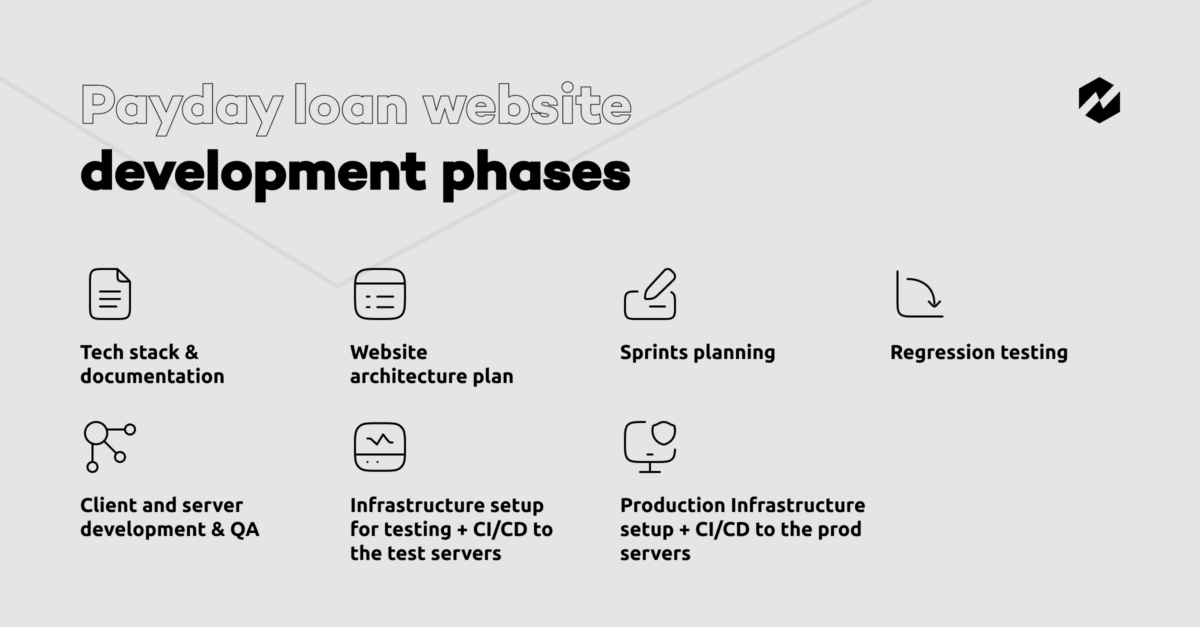

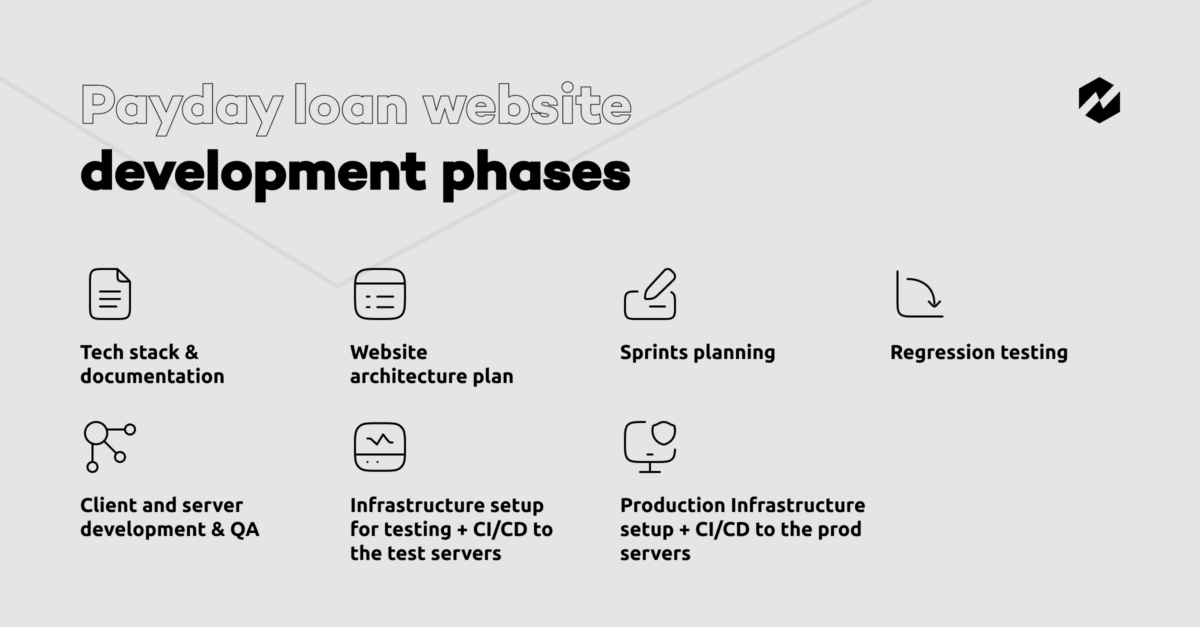

Now comes the most important stage. You need to turn the design into a real working product. At RewiSoft, we include the following steps in the development of any website:

- Tech stack & documentation. Our development team carefully selects the most suitable technologies for your project, crafting technical documentation outlining all capabilities and user roles.

- Website architecture plan. Developers act as architects for the website, carefully choosing components to design and construct the desired outcome. On the front-end side, they select a technology stack – such as monolith or microservices – with appropriate controllers and APIs. On the back-end side, experts plan out how it should appear in terms of its user interface while determining points at which different parts will communicate.

- Sprints planning. With careful consideration of priority and sequencing, we lay the groundwork for successful website development. This stage is essential to ensuring that all aspects work together in harmony toward reaching our desired goals.

- Infrastructure setup for testing + CI/CD to the test servers. We create a “real-world” environment on the cloud. This allows our customers to interact with and test out their website before it goes live – while also ensuring that any modifications made are properly mirrored and updated within this simulated environment.

- Client and server development & QA. At this stage, client and server parts of the website are developed (development of UI components, API, etc.) and tested.

- Regression testing. QA tests the entire website thoroughly. We fix bugs that may have appeared when we were adding new features and website components.

- Production Infrastructure setup + CI/CD to the prod servers. We create a separate, more flexible and scalable environment on the cloud that is production-ready. We configure domains and the system so that all changes we make to the product automatically appear in this environment.

Step 9. Launch

Now it’s time to present your payday loan website to the market. You need to be well prepared for this process and think through every step. Here are our recommendations on what you need to do at this stage:

- Target audience identifying.

- Unique product packaging creation.

- Slogan and timeline creation.

- Competitors analysis.

- Customer onboarding creation.

- Website creation.

- Advertising.

Take the First Step!

How RewiSoft Can Help You Make A Payday Loan Website

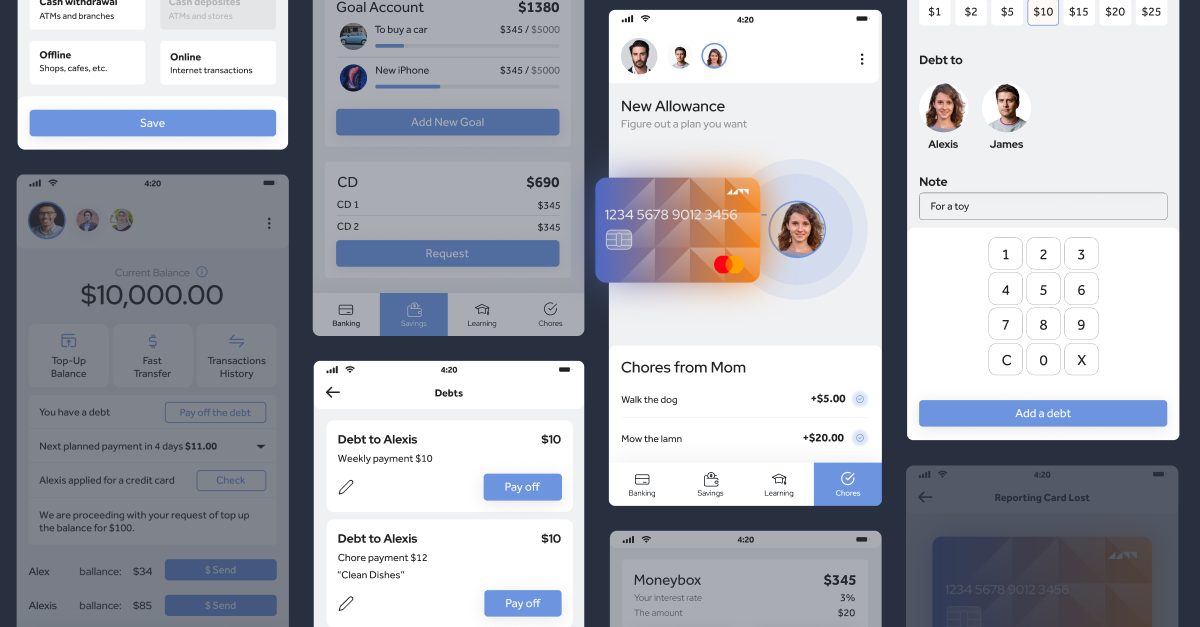

With deep expertise in Fintech, we provide end-to-end services for financial businesses that are both secure and easy to use. Our Fintech web development services range from creating custom web applications from the ground up to updating existing solutions with modern design elements and ensuring reliable integration with banking or payment systems. We guarantee the unparalleled performance of your digital presence so you can grow your business more confidently than ever before.

At RewiSoft, we have significant experience designing and developing payday loan websites. As we said before, we worked on some of the payday loan websites projects, so we have something to tell you.

One of our clients, Gojo, had a payday loan website, but it lacked certain functionality. Our work was divided into two iterations:

- The first was the creation of a repayment flow, i.e., the flow of how an officer will receive money from people who take a microloan.

- The second iteration was the development of an agent persona. An agent has more limited functionality than an officer but can also handle loans and process management. We developed the functionality and detailed user flows for the agent.

The main challenges of this project were:

- Provide a high level of security. We had to analyze the main user of the platform and make sure that the platform is secure and people can not steal data and money from it.

- Rebuild information architecture. In order for the new functionality of the platform to work smoothly and be logically connected with existing features, we rebuilt the information architecture.

- Redesign platform blocks. Taking into account the specifics of the platform and the region in which it is used, we created a new design system and completely updated the platform’s design, making it more attractive to users.

For Gojo, our team developed all the necessary application functionality and optimized the work of the existing one. With the help of the updated application, Gojo clients get microloans more conveniently, and, most importantly, reliably.

Another client, FinanceBrokers is a finance brokerage company operating in Romania and uses technology to automate the credit application processes. The main issue was to make the platform more enjoyable, comfortable for users, make as much color differentiation as possible between the results sections so that the user can see a clear difference between both the results and the actions.

The main challenges of this project were:

- Redesign the application. Based on the client’s requirements, we created a new design system and completely redesigned the block design of the platform. Thanks to this, we improved the user experience and the average time users spend on the platform.

- Provide a high level of security. In order for all monetary transactions on the platform to be secure, we created a security system that complies with all standards, norms and regulations of the FinTech industry.

- Create a mortgage calculator. Since one of our client’s requirements was to automate the mortgage process, we created a calculator using which users can calculate how much it is more profitable for them to take a mortgage.

As a result, we created such a platform for FinanceBrokers that would help their business to grow and develop.

Contact us to discuss your project details!

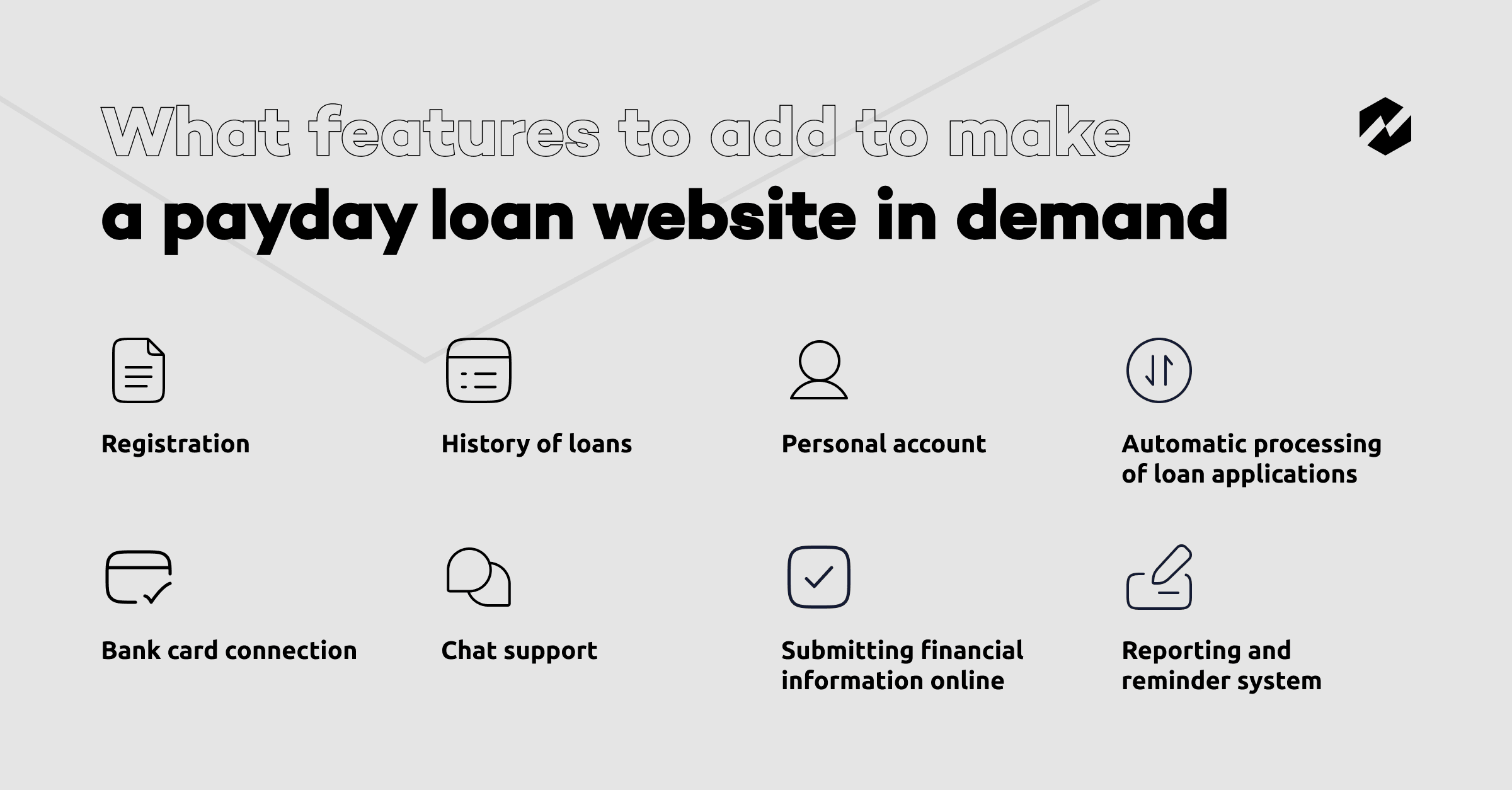

What Features to Add to Make a Payday Loan Website In Demand

How to make a payday loan website that will be competitive and in-demand? We’ll tell you how. Let’s start with the fact that in order for your site to be in demand among users, you should add features without which a payday loan website cannot exist. We have prepared a list of such features for you:

Registration

Without what, any site cannot exist? That’s right – without registration. Registration is the main element of the payday loan website. It should be simple, without unnecessary elements. A person should quickly and without any difficulties register on your site.

Personal account

A personal account should be minimalistic with the necessary forms to fill out. In a personal account, users should be able to add all their data and be sure that it will be protected.

History of loans

In order for users to view details of the loans they have taken out, a loan history is required. It should contain information about the date of taking the loan, interest rate, date of loan repayment, etc. This feature will help users control the process of taking loans.

Automatic processing of loan applications

For the process of taking a payday loan to be fast, your site needs a feature for the automatic processing of loan applications. It will save time for both you and your users. We developed this feature for one of the projects, Gojo, a tablet application for quick and efficient microloans in Asia. We will tell you more about this project later.

Submitting financial information online

This feature is necessary so that all information and data entering the website is quickly and correctly processed and submitted. This applies to filling out a profile, submitting applications, filling out a loan form, etc.

Bank card connection

Of course, a payday loan website should have a bank card connection feature. You should pay special attention to this feature, as using it, users will repay their loans. Make it possible for users to connect cards of different banks.

Chat support

For you to solve any problem users have while working with the site or answer questions, there should be a support chat. It should be prominently displayed on the website.

Reporting and reminder system

This feature is necessary so that users can receive reminders that, for example, they will soon be paying a loan, or that their loan has been approved. They will also be able to receive reports on, for example, how many loans they have taken recently, how much they have paid, etc.

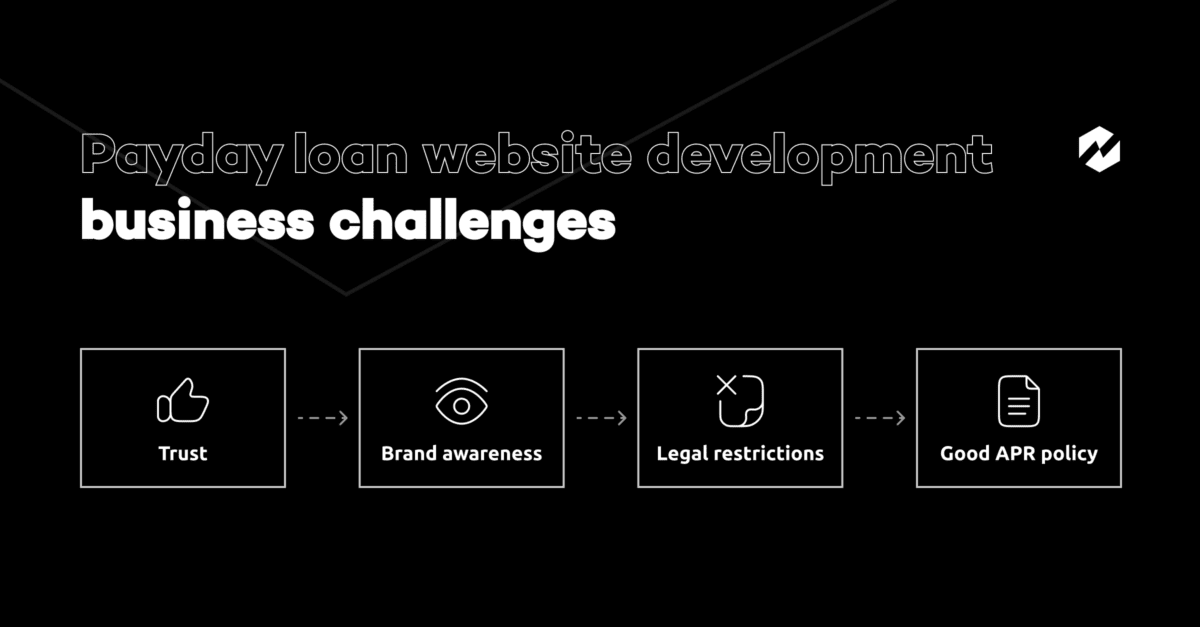

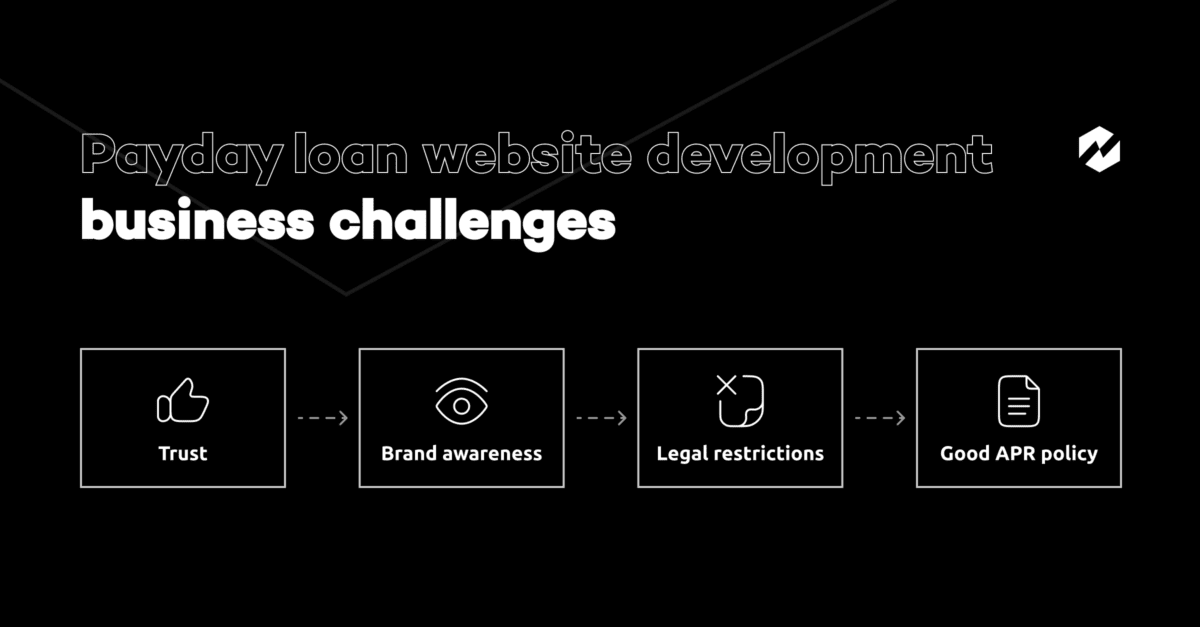

What Business Challenges You May Face During Payday Loan Website Development

Now let’s discuss the main challenges you will face while creating a payday loan website. We divided the challenges into several categories: business, technical, and design challenges. Let’s take a closer look at each of them:

1. Trust

Most importantly, your product should be credible. People today are very skeptical about payday loan websites. Therefore, you need to think about making people trust your site and use the service without a second thought.

2. Brand awareness

New companies and products always face this difficulty. Brand recognition is critical since it is pointless to create the finest marketing plan and campaign or introduce a new feature to your business if no one sees it.

3. Legal restrictions

If you are planning to scale your payday loan website in the future, you need to think about a loan restriction in your location. Study the restrictions in the financial sector in your country before you start a payday loan website so that you do not have to change a lot in the future. Here are some legal points to remember when building a payday loan website:

- GDPR compliance. If you develop a website for the EU market, you should ensure that your loan app is GDPR compliant. GDPR, or General Data Protection Regulation, went into force on May 25, 2018. If you don’t want to get fined, you can’t disregard or skip this step.

- CCPA compliance. The California Consumer Privacy Act (CCPA) is the law you must follow if you develop a website for California citizens. This law’s major purpose is to give people more control over their personal data. If California is your target market, you must make your money lending app CCPA-compliant beginning January 1, 2020.

4. Good APR policy

Annual Percentage Rate (APR) is a method of calculating the interest rate (and any additional costs) on a variety of financial products such as personal loans.

The annual percentage rate shows the number of interest customers will pay if they borrow money from your website. APR serves as a defined method of displaying the cost of borrowing over a year-long period.

Therefore, you need to think carefully about how to write an APR policy.

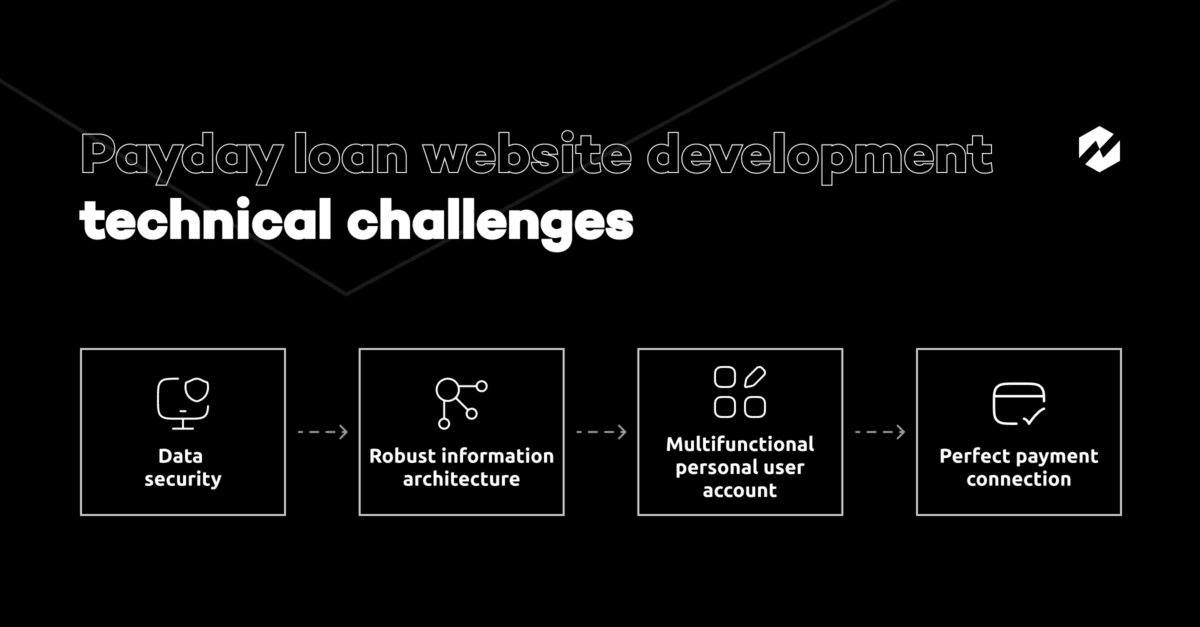

What Technical Challenges You May Face During Payday Loan Website Development

Here is a list of the technical challenges you will face:

1. Data security

Data security is vital for all financial institutions and products. To get a loan on your site, people will upload their documents and connect bank cards. Therefore, you will need to make the system as secure as possible from data leakage. You can, for example, add two-factor authentication to your website.

2. Robust information architecture

Information architecture plays a very important role in the creation of a payday loan website. Without it, you will not be able to build a website that will work logically and smoothly. Information architecture is responsible for connecting all platform content and its functionality. Building an information architecture for a product can be compared to an architectural plan for a skyscraper. It is hardly possible to build a solid building without a plan. The same situation is with the creation of the site.

3. Multifunctional personal user account

For users to use your website to the maximum, you will need to make personal user accounts multifunctional. Users should be able to perform as many actions as possible in their personal accounts.

4. Perfect payment connection

If users have trouble connecting their bank cards to your site, or encounter problems during the process, they are more likely to leave your site. Therefore, make sure that your payment connection system works flawlessly.

What Design Challenges You May Face During Payday Loan Website Development

Here is a list of the design challenges you will face:

1. Fast onboarding

How will people understand how to use your website? That’s right – with the help of a good and fast onboarding. So pay attention to this aspect during product development. Onboarding plays a critical role in whether a user chooses your product or not.

2. Great UX

As we said earlier, UX design is about the user experience of using your product. Therefore, the UX of your website should be implemented with a bang. Users coming to your site should achieve their goals in a few minutes.

3. Compliance with the marketing strategy

A good marketing strategy will help you get your product out to as many people as possible. Moreover, a clever marketing strategy will help convert as many ordinary visitors as possible into regular customers. Don’t forget to create a marketing site.

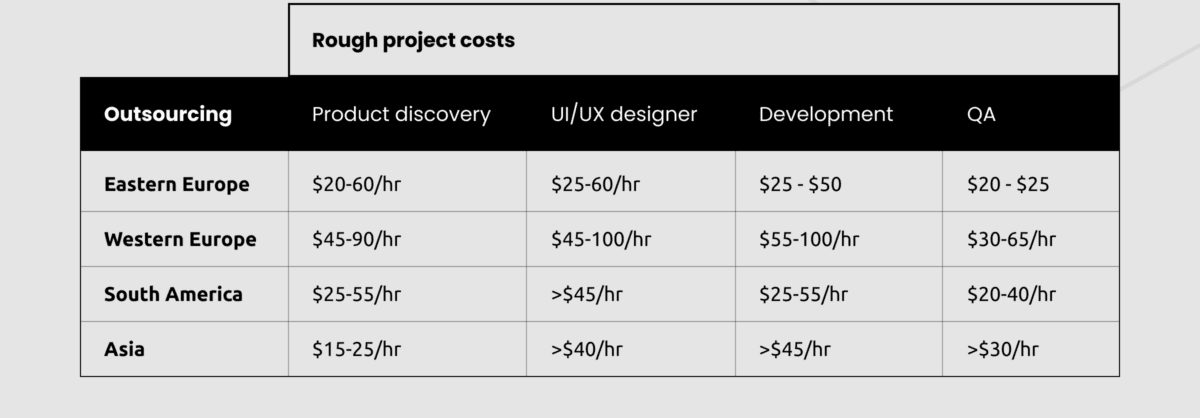

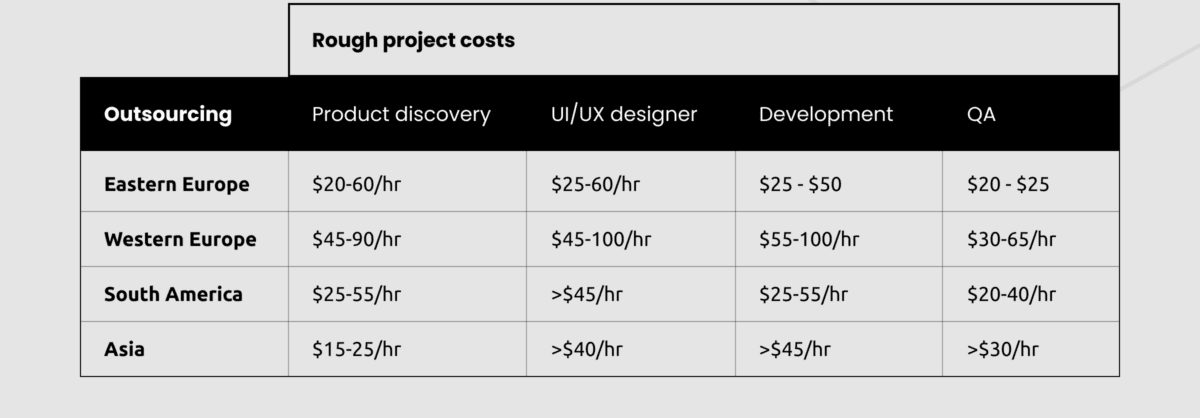

How Much Does It Cost to Make a Payday Loan Website

How to make a payday loan website and not lose lots of money and time? The cost of payday loan website development can vary greatly depending on the business size and the required functionality, so it is impossible to give an exact development figure. Most often, the price of payday loan website development depends on the following factors:

- Project size

- Number of features

- Functional complexity

- Design complexity

- Number of integrations

- Development team experience

However, we have compiled a table of approximate prices for different stages of development, depending on the country in which the design and development team is located.

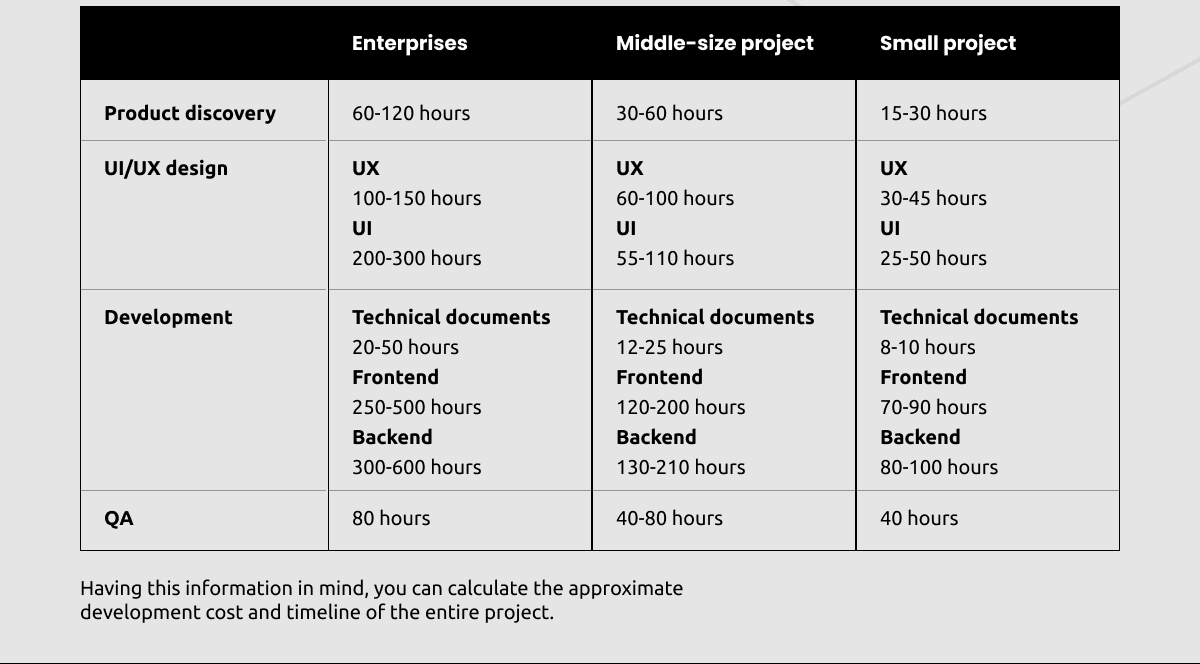

How Long Does It Take to Make a Payday Loan Website

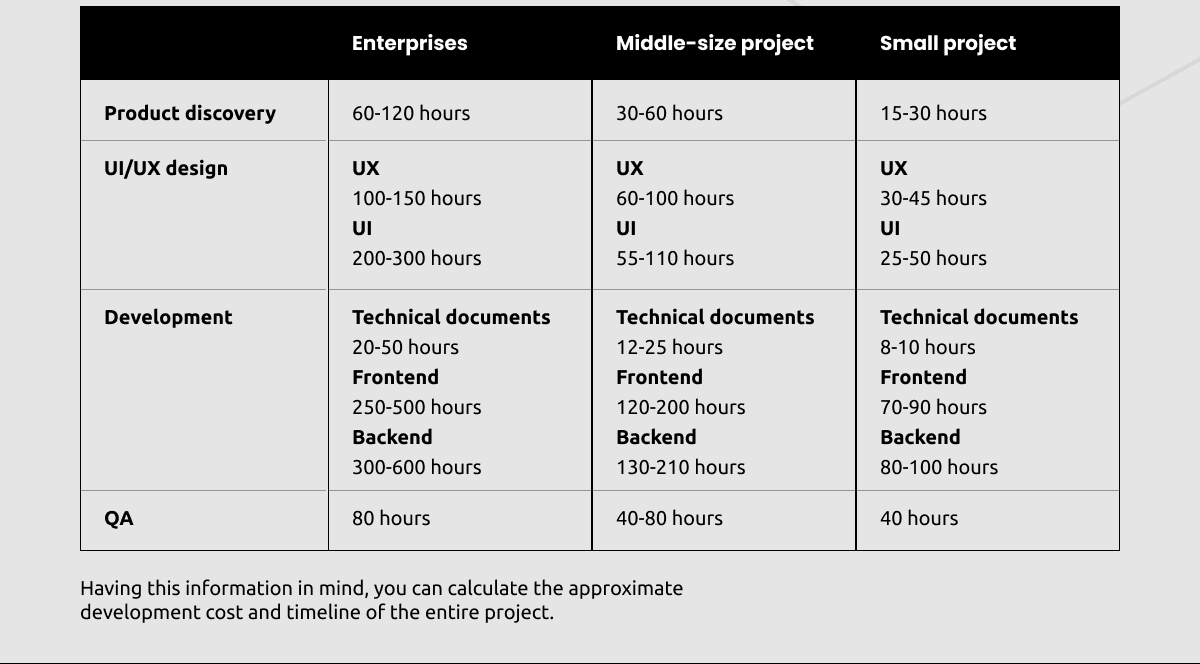

Let’s also consider how long it takes to create a payday loan website. It also depends a lot on the size and complexity of the project, the amount of functionality required, and the experience of the design team and the development team. For your convenience, we calculated how much time each stage of payday loan website development will take for different sizes of businesses.

Having this information in mind, you can calculate the approximate development cost and timeline of the entire project.

time

How to Make a Payday Loan Website: Summary

How to make a payday loan website? We hope we were able to answer this question in detail. However, if you still have questions or have an idea for a project, we are always in touch.

The key to a great product is a great team. Therefore, remember that to create a payday loan website, you will need the following specialists:

- PM (Project Manager)

- BA (Business Analyst)

- UX designer

- UI designer

- Front end developer

- Back-end developer

- QA engineer

We would also like to recommend tech stacks that are ideal for payday loan website development: React and Node.js.